Climate considerations now permeate the full spectrum of business operations. From insurance markets to central banking, traditional risk models are proving inadequate as climate impacts accelerate. This article examines the business impacts of climate risk, the strategic advantages of early action, and the ways in which markets and regulators are already responding.

Finally, we outline a structured approach to assessing material climate risks and opportunities, demonstrating how companies can move from insight to strategy, and in doing so, turn resilience into long-term competitive advantage.

Understanding climate risk’s business impact

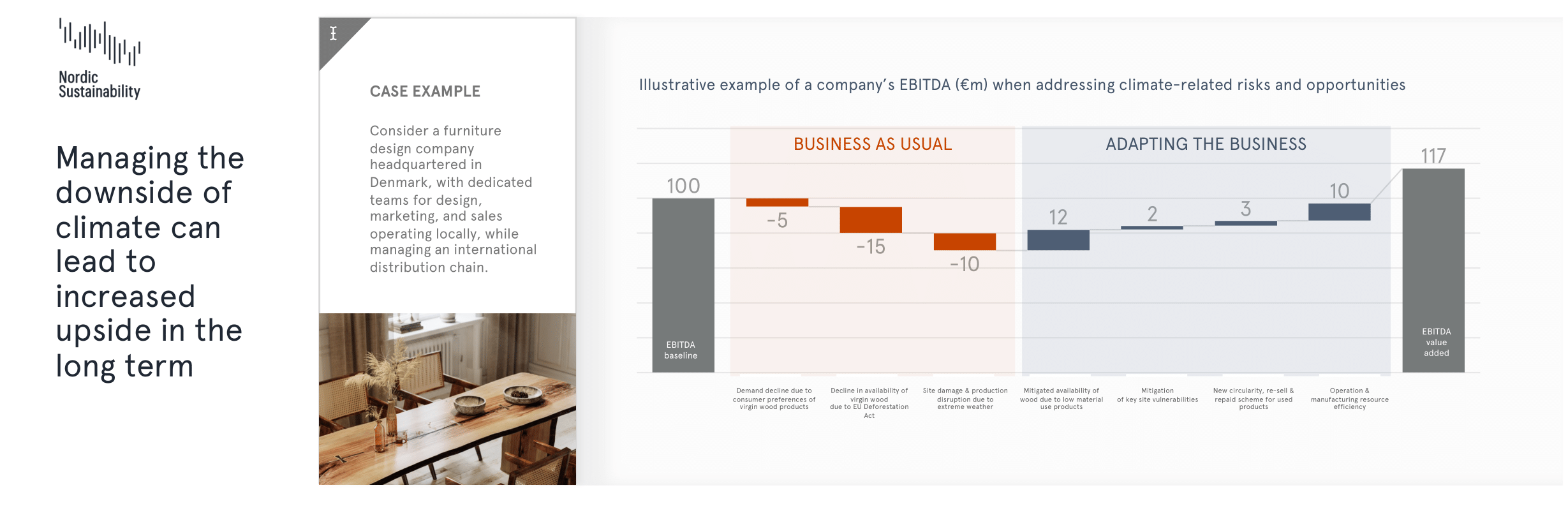

Climate risk has moved from abstract projections to measurable business realities. It now reaches directly into revenue streams, operational resilience, and the very continuity of organisations. Under the current trajectory toward 2.5-3°C of warming above pre-industrial levels, the World Economic Forum warns that unprepared companies could see 5–25% of profits at risk by 2050. For a company with $1 billion in annual earnings, climate risks equate to $50-250 million in loss within 25 years.

The nature of these risks makes them particularly destabilising. They are diffuse, often cascading through indirect channels rather than striking head-on. This results in inflated CAPEX and OPEX, and, in turn, eroding revenue. These risks do not have to impact your business directly to have an impact on revenue. If unaddressed, climate risks may ripple through your entire value chain, causing supplier disruptions, shifting customer preferences or declining investor confidence, all hurting revenue just as much as any physical damage.

The climate dividend of early action

Companies identifying and addressing climate-related risks early gain agility in an increasingly uncertain future, reduce sudden unplanned cost shocks, and stay ahead of competitors still relying on outdated assumptions.

Early movers see two major advantages:

1. Preservation of what you have built

- Minimise asset damage costs

- Prevent costly operational disruptions

- Understand & manage upstream and downstream value chain risks

2. Unlocking of new value streams

- Identify new opportunities linked to climate transitions

- Access favourable financing by demonstrating proactive risk management

Factoring these two priorities into strategy, companies escape highly exposed and vulnerable pathways and move toward stability, long-term strategic planning, and sustainable revenue.

The market is already pricing climate risk

Markets and regulators are no longer waiting.

The European Central Bank has now introduced a “climate factor” that adjusts bond collateral values based on climate-related risks, embedding these risks directly into monetary policy and financial markets. It signals a new era where climate risk is recognised as a material financial factor demanding immediate attention from investors and lenders.

Meanwhile, the UK Office for Budget Responsibility is among the first national institutions to put a clear price tag on climate risk on public finances. Its latest report estimates that climate change could add around 74% of GDP to public debt by the 2070s through reduced growth, revenue losses, and increased borrowing.

The insurance industry provides the clearest signal. Since 2021, 38 companies have withdrawn or limited home coverage in wildfire-prone areas of California. State Farm, one of California’s largest property insurers, received approval for emergency rate increases of 17% following recent fires in Los Angeles. The result is that climate risk is driving up insurance prices and reducing insurance offerings, moving property cover even further out of reach for many homeowners.

Regulatory frameworks such as the International Financial Reporting Standards on Climate-related Disclosures (IFRS) S2 require businesses to disclose their climate risks clearly. The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates broad sustainability disclosures across industries, pushing firms to embed climate considerations into business decisions. Australia’s AASB S2 mirrors these global standards with local climate disclosure rules. California’s SB 261 requires insurers and businesses to be transparent about climate risk exposure at the state level.

While these frameworks increase transparency and accountability, geopolitical tensions continue to slow regulatory progress, leaving many companies exposed to escalating climate risks and financial uncertainty. The impacts of climate-related risks do not wait for regulation.

Kickstart climate risk management today

The first step to securing long-term success is understanding which climate-related risks and opportunities truly matter to your business. Unlike traditional business risks, these require a different lens and expertise that many internal teams may not yet have. There are 3 key components of understanding your organisation’s material climate-related risks:

- Look at both physical and transition risks and opportunities (ROs)

To comprehensively understand which ROs are material to a business, it’s critical to conduct a broad screening of both physical ROs (how climate hazards are expected to change across scenarios) and transition ROs (how economic and societal climate drivers are expected to change across scenarios). - Test across multiple scenarios

Due to the variability in the warming trajectories that may be experienced globally, a likelihood is not assigned and, instead, multiple warming scenarios are assessed to understand how risks may vary under each scenario. - Think in time horizons

Risks and opportunities evolve through time as the conditions of the scenarios change. What looks manageable in the short term may become critical in the medium or long term. A full view requires assessing all three.

Here’s our approach to navigating and addressing climate-related risks and opportunities:

Moving from climate risk insights to strategy

Once material climate-related risks and opportunities have been mapped, the next step is to move beyond a high-level understanding and towards practical business planning. This involves quantifying the value at stake and translating risks into decision-useful values.

At Nordic Sustainability, we employ our strategy expertise to take those quantitative outputs and look beyond compliance. Our focus is on long-term value creation, developing adaptation and mitigation strategies. We test them against existing business models and build tailored roadmaps that can be integrated into day-to-day decision-making. In turn, building resilience to ensure businesses preserve what they have built and seize the opportunities from new value streams.

Ready to begin your climate transformation strategy?

Reach out to our Senior Manager and Climate Risk Lead, Ottilly Mould omo@nordicsustainability.com

Read more

- The cost of inaction: A CEO Guide to Navigating Climate Risk Report

- European Central Bank’s climate factor

- UK’s Office for Budget Responsibility, Fiscal Risks and Sustainability Assessment

- IFRS S2 Climate-related Disclosures

- The latest on the CSRD

- White paper on the implications of the Los Angeles wildfires

- Australian Sustainability Reporting Standard AASB S2

- California’s Senate Bill 261 (SB 261) on the Climate-Related Financial Risk Act

The European Central Bank's climate factor

The ECB recently examined how climate risks affect its own investments and found that corporate bonds remained the most exposed. To address this, the ECB introduced a “climate factor” into its collateral framework. Find out why and how this impacts your organisation in our article.