ESRS E1 is a standard addressing climate change mitigation, climate change adaptation, and energy. Due to the current climate crisis, this topic will be a material issue for most companies, who must publicly report on impact, plans, and progress annually – covering 220 data points.

On May 22nd, 2024, we hosted a webinar on reporting on the climate standard (ESRS E1) under the EU’s new reporting requirements (CSRD). Maria Steingrimsdottir and Minna Shukri, sustainability strategy and reporting experts, led the session.

Companies in scope of the CSRD

FY 2024: < 11.700 companies already subject to the non-financial reporting directive (NFDR), i.e. companies with over 500 employees.

FY 2025: Non-NFDR companies meeting three of the following criteria: 1) <250 employees, 2) <50 million € turnover, 3) balance sheet of <25 million €.

FY 2026: Listed and non-listed SMEs, small credit institutions, captive insurance, and reinsurance companies. SMEs will have the option to opt-out during the transition, exempting them from the directive until 2028.

FY 2027: Non-European countries with a net turnover within EU borders of <150 million € (uncertainties exist regarding the timeline of these companies).

Five key shifts in sustainability reporting going forward

Why is the ESRS E1 important?

Climate change is a topic with a large scope. It is the only topical standard where, if deemed non-material, the company must provide a detailed justification and analysis of why it isn’t. These are the three reasons we think justify a “as-soon-as-possible” policy when preparing for the directive:

- Material Relevance: ESRS E1 is pertinent for nearly every company, emphasising the importance of starting implementation efforts immediately.

- Data Intensity: It demands a high volume of quantitative data, necessitating robust data collection and management processes. And we all know how time and resource-consuming that is.

- High Expectations: Due to the mature state of climate awareness, there are substantial expectations from both internal and external stakeholders.

The four building blocks of the reporting standards and the E1 requirements

The reporting standards framework consists of four building blocks:

Each of the 10 topical standards covered by the directive is linked to single or multiple blocks.

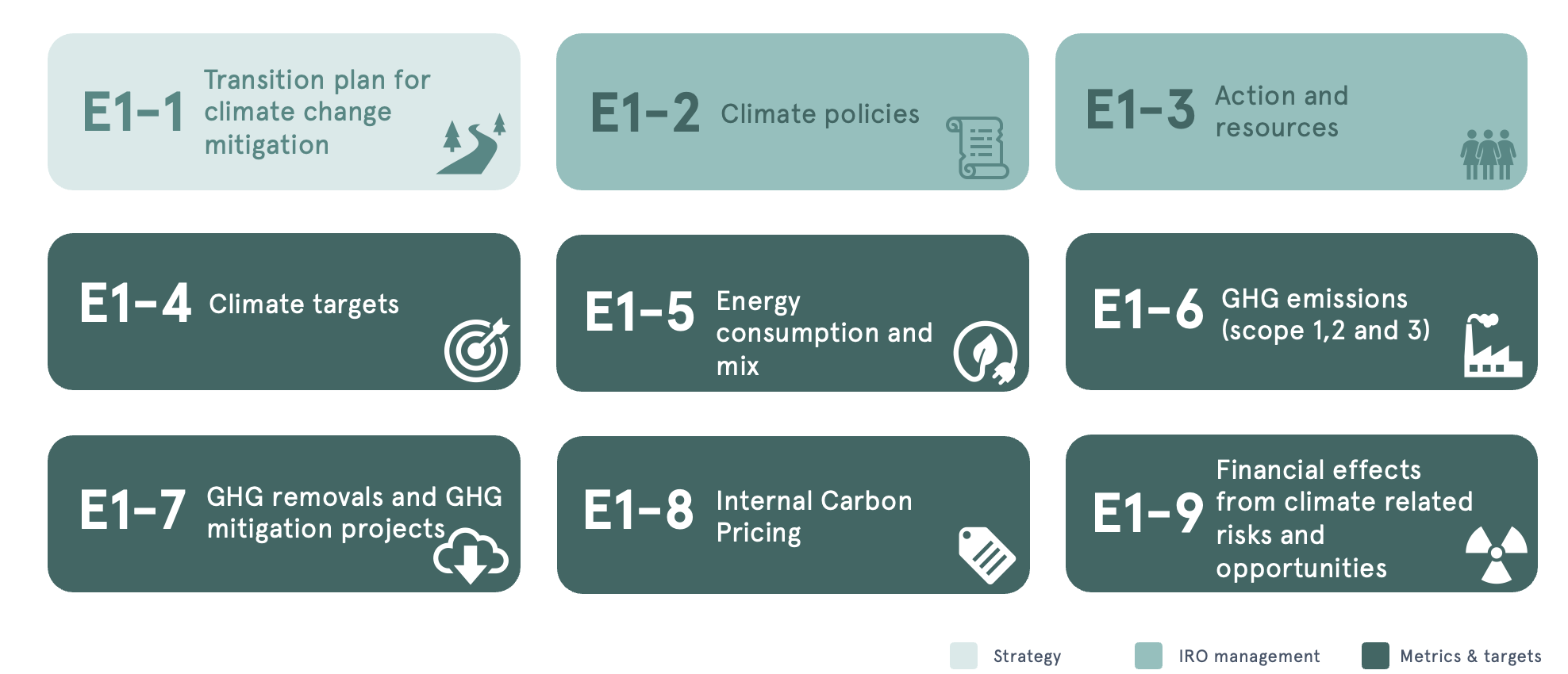

ESRS E1 Climate Change covers 9 disclosure requirements. These disclosure requirements are embedded within different building blocks of ESRS. For instance, the transition plan is part of Strategy, while climate policies, actions, and resources fall under the Risk management.

220 ESRS E1 datapoints

There are 220 data points under the ESRS E1, and they are organised as follows:

ESRS E1 implementation in 5 steps

You should follow a structured approach to implement the ESRS E1 standard effectively and drive meaningful climate action. Below are the five essential steps that can help you make informed decisions throughout this regulatory journey:

- Calculate your GHG inventory to identify your main emission drivers and have a baseline to measure progress from:

- Establish a comprehensive GHG inventory, covering all three scopes described in the GHG protocol and all emissions under your operational control.

- Report GHG intensity and provide a detailed energy consumption overview.

- Exclude any GHG removals, storage, or carbon credits.

- Understand your climate-related financial risks and opportunities:

- Assess financial effects from material asset-related risks over short-, medium-, and long-term scenarios.

- Evaluate financial effects from material climate transition risks.

- Identify potential climate-related opportunities, such as cost savings from mitigation and adaptation actions or revenue changes from low-carbon alternatives.

- Develop and implement climate policies:

- Integrate climate-related matters into existing policies, such as travel, procurement, training, investment, and supply chain policies.

- Ensure policies are concise, signed by management, publicly available, and reviewed annually.

- Set climate targets:

- Establish targets for 2030 and, if possible, 2050.

- Use the Science-Based Targets (SBTi) framework for validation and transparency.

- Intensity targets are allowed, but associated absolute values must also be reported.

- Create a climate transition plan:

- Develop a detailed plan outlining the decarbonisation levers and specific initiatives for decarbonisation. The transition plan should describe the pathways and milestone that the company needs to achieve in order to reach climate targets.

- Quantify investments and align the plan with business strategy and financial planning.

Q&A insights

How can SMEs tackle CSRD and potentially go beyond?

To tackle CSRD there are two options for SMEs in Europe:

- If you are a listed SME and subjected to CSRD follow the guidelines we presented in this session but also look into those published by EFRAG.

- If you are not subjected to CSRD, but you want to work with it nevertheless check the voluntary standard developed by EFRAG.

If you want to go beyond mere compliance, we recommend you start with:

- Map out your customers and determine who will be subjected to CSRD. Reach out to them proactively, letting them know that you are 1) aware that they are subject to CSRD and 2) inform them of your own level of maturity and how you plan to improve gradually. This shows readiness and awareness while reducing internal stress by staying ahead of the curve.

What is the link between EU taxonomy and ESRS E1?

There are overlaps between the EU taxonomy for CSRD that allow you to reuse data from, but there is also a major difference. CSRD focuses on the company level, whereas EU taxonomy focuses on the activity level. However, there are similarities in some of the disclosure requirements for example actions and resources, where you need to report on operating and capital expenses to implement the decarbonisation actions you have identified, and here you can directly use data from the taxonomy in the ESRS E1 reporting. In disclosure requirement E1-1, you need to describe how the transition plan aligns with the EU Taxonomy.

How does the nine disclosure requirements of E1 overlap with the subtopics for E1?

If your company only has one material climate change topic, some disclosure requirements will not be triggered, and you do not need to report on the data points under these. But keep in mind that there are a decent number of cross-cutting data points that need to be reported on for all the subtopics of climate change.

How can I develop IROs that serve reporting purposes and give an overview of the company’s reality based on integrated assessment models?

Begin with the double materiality assessment to identify your most material impacts, risk and opportunities. Your CSRD report will detail how these factors are integrated into your business model. Utilise the governance aspects of the CSRD to anchor these considerations within your organisation.

Why should companies set 2030 targets if they don’t start reporting before 2028?

- Setting near-term targets is a great way to accelerate climate action. The more you reduce your emissions, the more positive impact you are generating on the environment and the planet. ESRS also requires you to reset your targets every five years.

- Finally, setting targets will help you speed up the process and make better-informed decisions when your reporting journey starts.

Implementing ESRS E1 is a comprehensive process that requires strategic alignment, robust data management, and transparent reporting. By starting early and following a structured approach, companies can ensure they meet the data and reporting requirements while leveraging this opportunity to enhance their sustainability strategies and performance.

The five-step approach provides a clear roadmap to achieving ESRS E1 Implementation.

- Completing a comprehensive GHG inventory,

- understanding climate risks and opportunities,

- developing robust climate policies,

- setting clear climate targets, and

- creating a detailed climate transition plan.

Want to know more?

Go check our related offerings on the link below.