The Carbon Border Adjustment Mechanism (CBAM) is the EU’s tool designed to impose a price on emissions generated during the production of carbon-intensive goods outside the EU. Set to take full effect in 2026, CBAM requires businesses importing regulated products, such as steel, cement, and aluminium, to cover the cost of the carbon footprint of these materials. This urges companies to transition to cleaner, less carbon-intensive materials and production methods. In this guide, we delve into CBAM’s requirements and offer practical insights to help your company prepare for compliance.

Promoting fair competition and cleaner production

In response to the ongoing climate crisis, the EU has adopted legislative measures to accelerate decarbonisation across European industries. As the EU advances its climate legislation, the risk of ‘carbon leakage’ also increases. Carbon leakage occurs when EU companies relocate their production to places with less stringent climate regulations than the EU, often resulting in higher CO2 emissions. The CBAM aims to prevent carbon leakage while ensuring that EU producers facing carbon pricing can compete on fair terms with non-EU producers. Ultimately, the CBAM incentivises global industries to adopt low-carbon technologies and renewable energy to reduce embedded emissions in products (Section 9, CBAM Regulation).

CBAM focuses on carbon-intensive industries

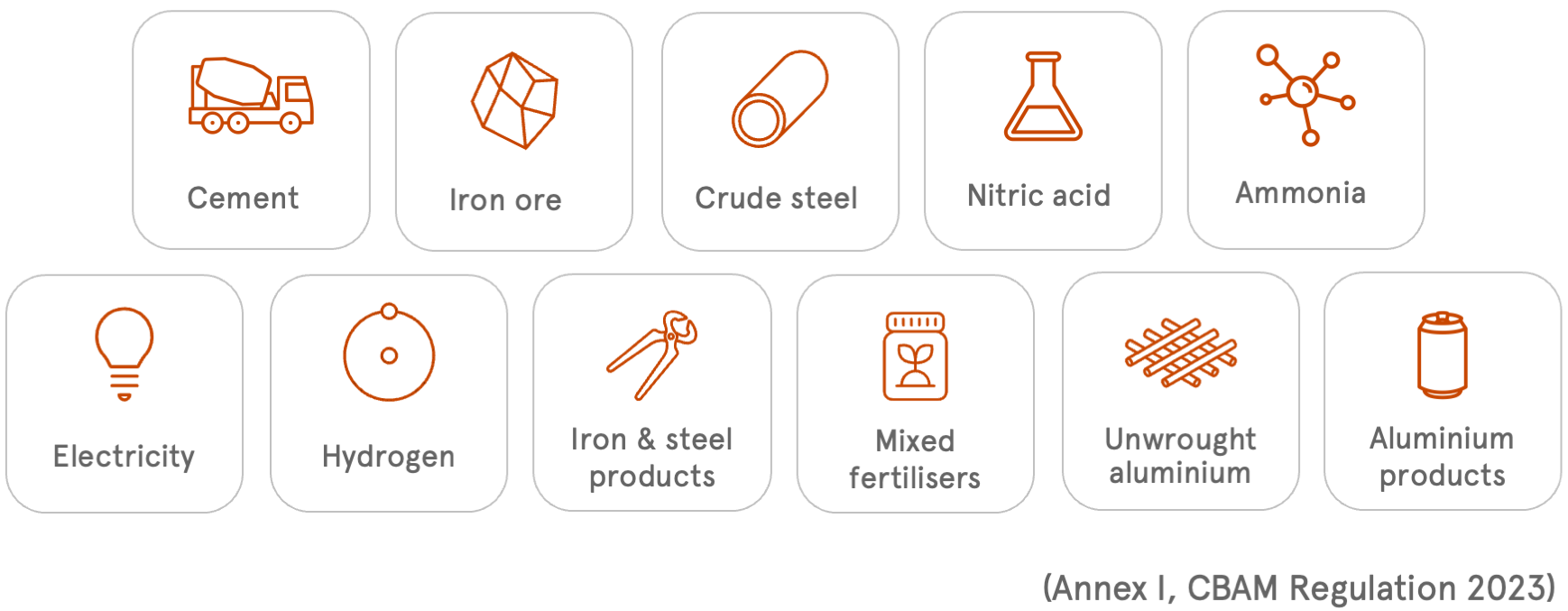

CBAM targets imported raw materials and products at a high risk of carbon leakage.

- This Regulation applies to goods listed in Annex I originating in a third country, where those goods, or processed products from those goods resulting from the inward processing procedure referred to in Article 256 of Regulation (EU) No 952/2013, are imported into the customs territory of the Union.

Currently, the following group of products are subject to the CBAM:

The regulation covers all businesses importing listed CBAM goods into the EU. The only exception is individual consignments with a value of less than EUR150 (CBAM FAQ from the EU, §29).

Currently in the reporting phase

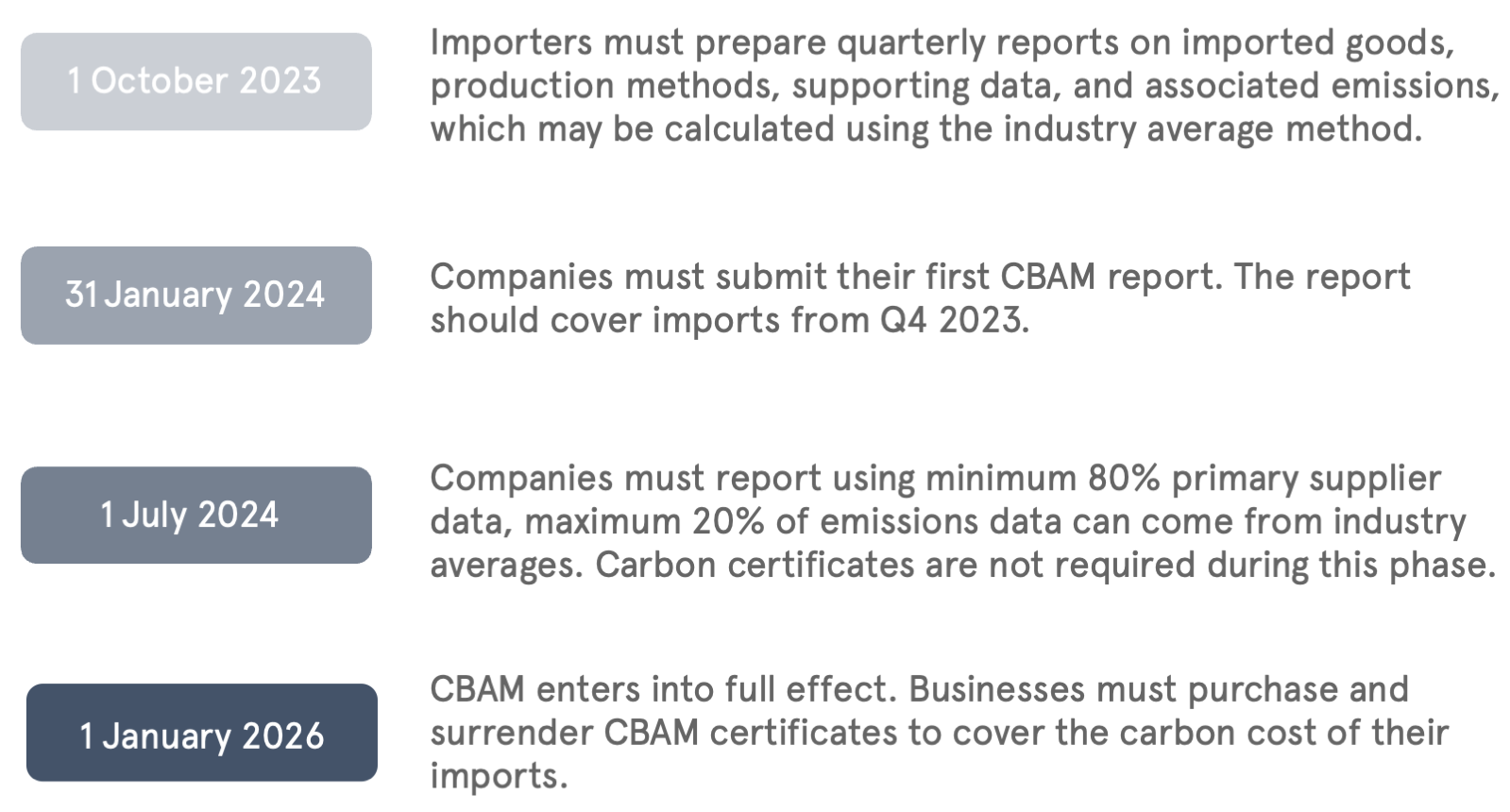

Until the end of 2025, CBAM will be introduced through a transitional period where companies in scope must engage in reporting (§32).

CBAM implementation timeline

Many businesses struggle to keep up with CBAM reporting and primary data collection

It’s important to note that while the timeline assumes companies should have initiated CBAM reporting some time ago, this is not the case for many organisations. We’re seeing companies either struggling to gather the necessary data or unsure how to get started. With the recent shifts to the reporting requirements and the CBAM’s definite regime approaching in a year, businesses must speed up CBAM implementation.

If you’re calculating your emissions with industry-average methods, you need to switch up your methodology—at least 80% of your emissions data must now come directly from your suppliers. Before July 2024, companies could use industry average data for CBAM reporting. This approach allowed businesses to convert their procurement/quantity data into emissions using industry average conversion factors—similar to spend-based or average data methods used for purchased goods and services in scope 3 accounting (CBAM FAQ from the EU, 2024).

Primary data means data sourced directly from your suppliers

Primary supplier data refers to emissions information sourced directly from suppliers, meaning the producers or exporters of CBAM-regulated goods. First-hand supplier data provides companies with the most accurate picture of the embedded emissions in imported carbon-intense products and materials, which is crucial for navigating financial adjustments from 2026 and beyond.

Determine if you are in scope

If you’re in doubt about whether your company falls under CBAM requirements, consider these steps:

- Identify if your organisation is currently managing CBAM reporting internally.

- Examine existing practices, ensuring that the reporting methodology aligns with the latest requirements (incorporating data directly from suppliers).

- Ensure your suppliers are equipped to provide accurate emissions data as required.

The cost of non-compliance

Companies failing to meet reporting requirements risk fines ranging from 10 to 50 EUR per tonne of CO2 emitted. The exact costs and repercussions are determined at the national level in EU Member States (CBAM FAQ from the EU, §17).

While there may not be immediate consequences for non-compliance, penalties will incur once the transition period ends in 2026. Early preparation is essential to ensure your organisation has processes in place to report accurately.

Preparing for successful CBAM compliance

Establishing robust processes for gathering and reporting first-hand supplier data is key to successfully meeting CBAM requirements in 2026.

Our specialists can guide you further on your CBAM reporting and decarbonisation journey:

Caterina Krumbiegel, Senior Consultant, specialised in greenhouse gas accounting.

Ole Høy Jakobsen, Principal and Head of Nordic Sustainability’s Climate team.

Read more

CBAM Regulation

CBAM FAQ