Earlier this year, the Science Based Targets initiative shared a draft version (V2.0) of its Corporate Net-Zero Standard for public feedback over the summer. The final standard won’t be in place until 2027, but the draft already signals some shifts worth keeping an eye on. We’ve reviewed the proposed changes and assessed their significance.

For those new to the Science-Based Targets initiative, here’s why the V2 draft is important

The Science Based Targets initiative (SBTi) provides a framework for companies to set emission reduction targets aligned with climate science and the goal of limiting global warming to 1.5 degrees Celsius. But to strengthen its guidance, the SBTi is now revising its Corporate Net-Zero Standard, which is the benchmark for how companies define, set and deliver credible net-zero targets across Scope 1, 2 and 3 emissions.

The draft V2.0 standard is designed to move companies closer to the vision of net-zero by 2050, requiring deeper Scope 1 reductions, a faster transition to zero-carbon energy under Scope 2 and stronger integration of Scope 3 action into procurement and business strategy, alongside non-emission metrics to track broader progress. V2.0 therefore raises the speed, ensuring businesses don’t stand still while climate ambition moves forward.

The draft introduces some dense and technical information, but we’ll break them down scope by scope, outlining the changes as well as explaining why the changes have been introduced. We’ll begin by examining what the draft says about Scope 1 and 2.

Some of the most significant changes to Scope 1 and 2 emissions

Change #1: The separation of Scope 1 and 2 targets

The V2 draft requires companies to set separate targets for Scope 1 and Scope 2.

Why? We need to use cleaner energy, but we also need to use less energy to achieve 1.5 degrees. Previously, Scope 1 (direct emissions) and Scope 2 (purchased energy) were combined into a single target. The draft now separates them, recognising their unique challenges and redirects focus to electricity sourcing. This prevents strong progress in one scope from covering up weak action in the other, as Scope 2 emissions can be easier to decarbonise in many regions.

For example, companies can lower their Scope 2 footprint through market-based mechanisms such as renewable energy certificates (RECs) or guarantees of origin (GOs). However, location-based emissions reflect the grid mix where electricity is consumed and may remain high if the regional energy system is still carbon-intensive. By requiring separate targets, the draft aims to ensure that reliance on market instruments does not mask slower progress in Scope 1.

Change #2: Stronger target requirements and timelines

Companies must set mandatory near-term targets for both Scope 1 and 2. These targets should be defined in fixed five-year intervals, leading up to their net-zero target year.

Why? SBTi aims to close the gap between long-term net-zero pledges and actual short-term action. Each near-term target must be supported by a long-term goal to demonstrate a credible path to full decarbonisation.

Change #3: Improvement of the Absolute Contraction Approach for Scope 1

The SBTi currently offers two methods for setting and assessing corporate emission reduction targets. The Absolute Contraction Approach (ACA) is a ‘one-size-fits all’ method that applies the same percentage reduction across all companies, ensuring absolute emission cuts in line with global decarbonisation pathways. By contrast, the Sectoral Decarbonisation Approach (SDA) tailors reduction pathways to sector-specific realities, using activity-specific metrics for carbon-intensive industries such as power generation, aviation or cement production.

The V2.0 draft now introduces two variations of ACA:

- One variant requires all companies to follow alinear path to net-zero by 2050

- The other factors in a company’shistorical emissions, aligning reduction efforts with a fair share of the global carbon budget.

Why? The revision aims to balance carbon budget conservation while recognising and rewarding early action. While the ACA now has two variants under the draft, most sectors can still choose between ACA and SDA, with a few exceptions.

Change #4: Targets on location-based and market-based emissions in Scope 2

For Scope 2, companies must now set two targets: one location-based, and either a market-based or a zero-carbon electricity target. Both must align with reaching net-zero by 2040. When companies choose the market-based route, for example through RECs or PPAs, stricter rules now apply. These instruments must meet both of the following criteria:

- Time matching: clean energy must be generated at the same time it’s consumed

- Geographic matching: clean energy must be produced in the same region where it is used

Why? The draft underscores the need for strong near-term action to stay on track for net-zero by 2040. While earlier guidance allowed companies to choose between location-based or market-based Scope 2 targets, the new requirements ensures that progress reflects the actual grid mix and pushes companies to secure credible clean supply, rather than rely on certificates alone.

The big one: key changes to Scope 3 emissions

Scope 3 often makes up the largest share of a company’s footprint. In sectors such as agricultural commodities, construction and capital goods, Scope 3 can account for more than 90% of total emissions. As these emissions occur in the value chain, they are the hardest to measure and manage.

In the V2.0 draft, we see that the standard moves from broad, percentage-based requirements to a more practical, focused approach that prioritizes action and influence for Scope 3 emissions.

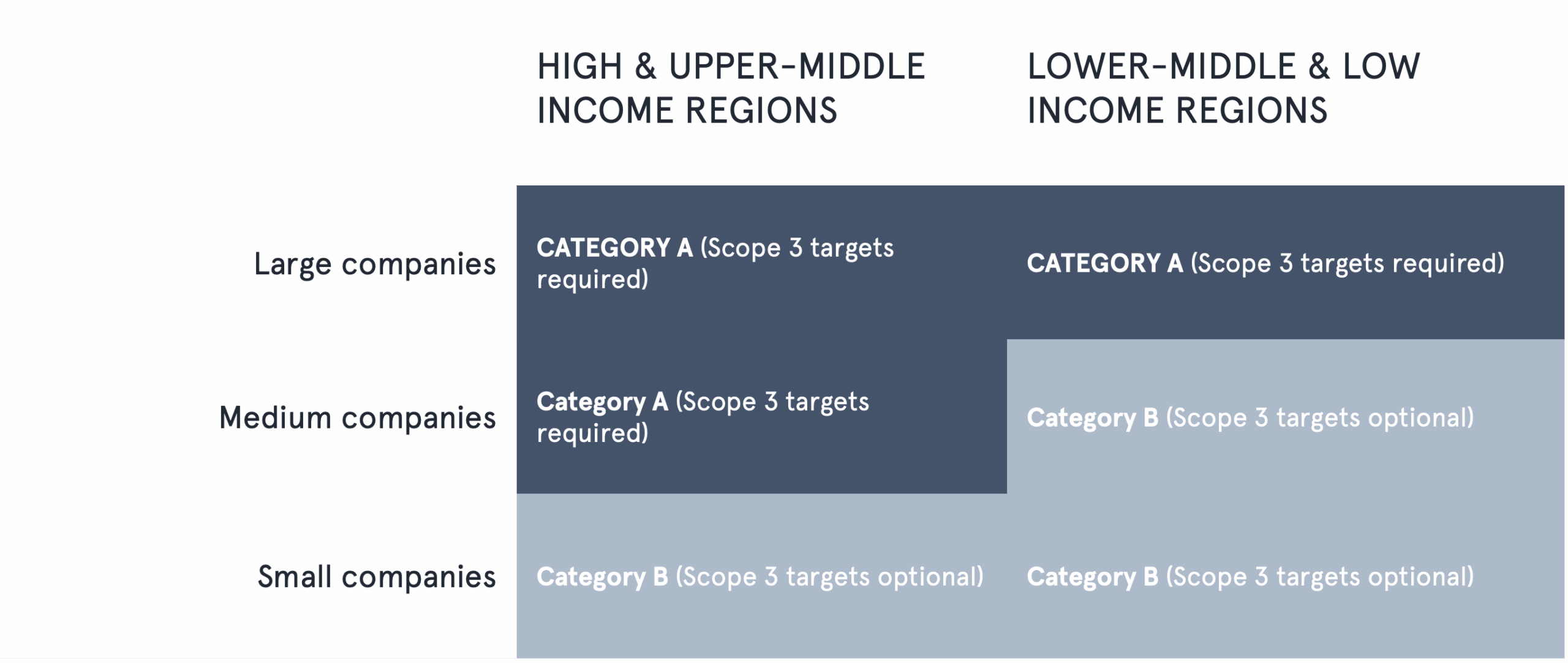

Change #5: Target requirement by company type

Companies are categorized by size and geography to determine whether Scope 3 targets are required. The framework distinguishes between large, medium, and small companies in high- and lower-income regions.

Large companies are defined as those with net turnover above €450 million or with more than 1 000 employees.

Medium companies are defined as those were at least two thresholds are met: either total assets above €25 million, net turnover between €50–450 million or with more than 250 employees.

Small companies are defined as those with less than 10 000 tonnes of CO2 from Scopes 1 and 2 combined, and that meet at least two additional criteria: total assets below €25 million, net turnover below €50 million, and fewer than 250 employees.

This categorisation determines whether a company is required to set Scope 3 targets or whether doing so remains optional.

Why? Under the current standard, companies must set Scope 3 targets if these emissions account for 40% or more of their total emissions. The new approach is more straightforward and targeted: instead of a single percentage threshold, it introduces clear rules by company type. The aim is to drive climate action across all companies, while recognising differences in size, resources and operating context. Smaller companies in lower-income regions are generally responsible for a smaller share of global emissions. The new framework captures this imbalance by scaling requirements to focus on companies that contribute most to global emissions.

Change #6: Target boundaries based on relevance

Rather than covering a fixed percentage of Scope 3 emissions (67% for near-term targets and 90% for long-term), the draft requires companies to focus on the most significant and influenceable sources in their value chain.

Why? The draft recognizes how difficult it can be for companies to obtain accurate primary emissions data across complex value chains. To address this, the draft now introduces more emphasis on the use of non-emission metrics, such as the share of procurement directed towards activities or activities which align with global climate goals, or the share of revenue coming from net-zero aligned products and services.

Change #7: More flexible methods for Scope 3 targets

The draft introduces the alignment method as a new, optional way for companies to set Scope 3 targets. Instead of focusing only on absolute reductions, companies can track how much of their value chain is aligned with net zero. Targets can be set based on:

- Upstream: Share of procurement spent on net-zero aligned suppliers, particularly for emissions-intensive activities

- Downstream: Share of revenue from products and services that are net-zero aligned

Companies are expected to increase alignment steadily over time, reaching full alignment by 2050.

Supplier engagement targets

Separate from the alignment method, the draft also introduces supplier engagement targets. These require companies to increase the share of Tier 1 suppliers (by spend) that are transitioning to, or already operating at, a performance level compatible with net-zero. High-priority suppliers linked to emissions-intensive activities must align by 2030, while all others must do so progressively, reaching net-zero by 2050.

Why? Scope 3 emissions are notoriously difficult to track, with limited visibility into supplier practices and frequent data gaps. The alignment method gives companies more flexible tools to demonstrate progress, while supplier engagement targets leverage companies direct influence over Tier 1 suppliers and prioritise early action where emissions are highest. Together, they aim to ensure that value chain move in line with 1.5 C pathways.

My company has already set near-term targets, what happens now?

As the Corporate Net-Zero Standard V2.0 is still only a draft and subject to change, companies setting targets in 2025 and 2026 will continue to use the current SBTi criteria. These near-term targets will remain valid for five years or until 2030, whichever comes first, after which new targets must align with the revised V2.0 standard. Targets set in 2027 or later will follow the new version of the standard.

That said, companies can take steps now to prepare before the changes enter into force.

Preparing for the V2.0 draft

Under the new draft, companies should develop and publicly disclose a climate transition plan (CTP) within 12 months of initial validation, outlining the actions they will take to achieve net-zero emissions by 2050 at the latest. Success requires an adaptive, transparent, and well-integrated approach. If you are unsure where to start your decarbonisation journey or need support in developing your CTP, our team has guided numerous companies through the process.

Learn how to craft a credible climate transition plan here

Preparing for the updated standard also means building capacity across all scopes. Each scope comes with its own priorities:

Scope 1: Improve your operational efficiency and prepare for electrification and the use of alternative fuels, while building systems to track Scope 1 progress

Scope 2: Reduce your energy use and invest in on-site or near-site clean energy, while aligning Scope 2 planning with Scope 1 electrification

Scope 3: Start by mapping emissions across your value chain and focusing on the categories with the greatest impact, such as purchased goods or product use. Companies can rely on a mix of metrics to show progress, combining emissions data with indicators like supplier spend or product revenue, where that provides a clearer picture.

If you want to get started with your company’s decarbonisation journey, start crafting a climate transition plan or unsure how to proceed with the proposed changes, you can reach out to our team of experts at Nordic Sustainability. We can help you navigate.

Responding to the V2.0 draft: three different scenarios

To illustrate what the V2.0 updates might mean in practice, we’ve outlined three simple scenarios: one each for Scope 1, 2 and 3, using examples from different sectors.

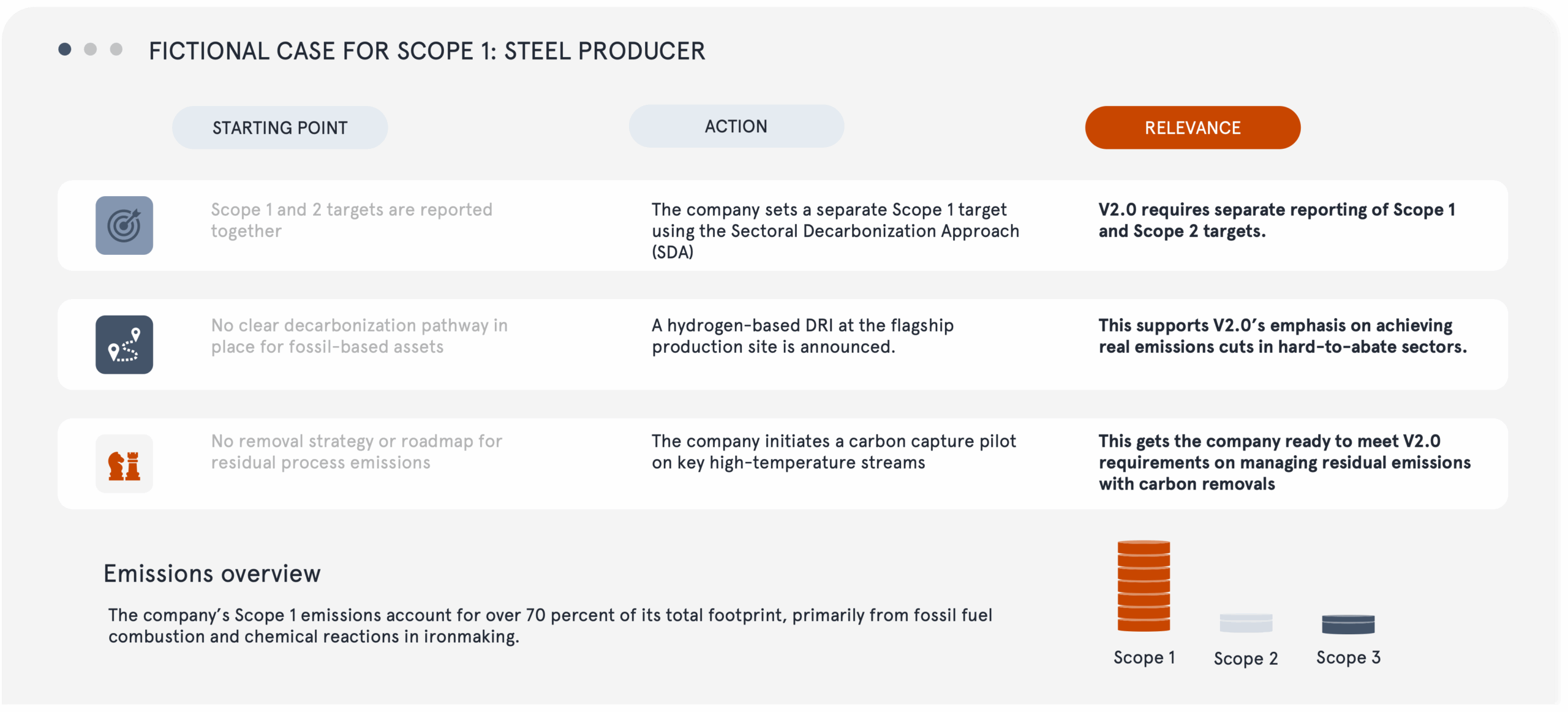

Scope 1: A steel producer tackling process emissions

A multinational steel company operates integrated production facilities across Europe and Asia. Steelmaking is one of the most emissions-intensive sectors globally, due to reliance on coal-based blast furnaces and high-temperature processes. The company’s Scope 1 emissions account for over 70 percent of its total footprint, primarily from fossil fuel combustion and chemical reactions in ironmaking.

Under SBTi V1, the company reported a combined Scope 1 and 2 target. Under SBTi V2.0, the steel producer must set a separate Scope 1 target, which it does by using the Sectoral Decarbonisation Approach (SDA) providing sector-specific benchmarks that better capture the decarbonisation pathway for steelmaking.

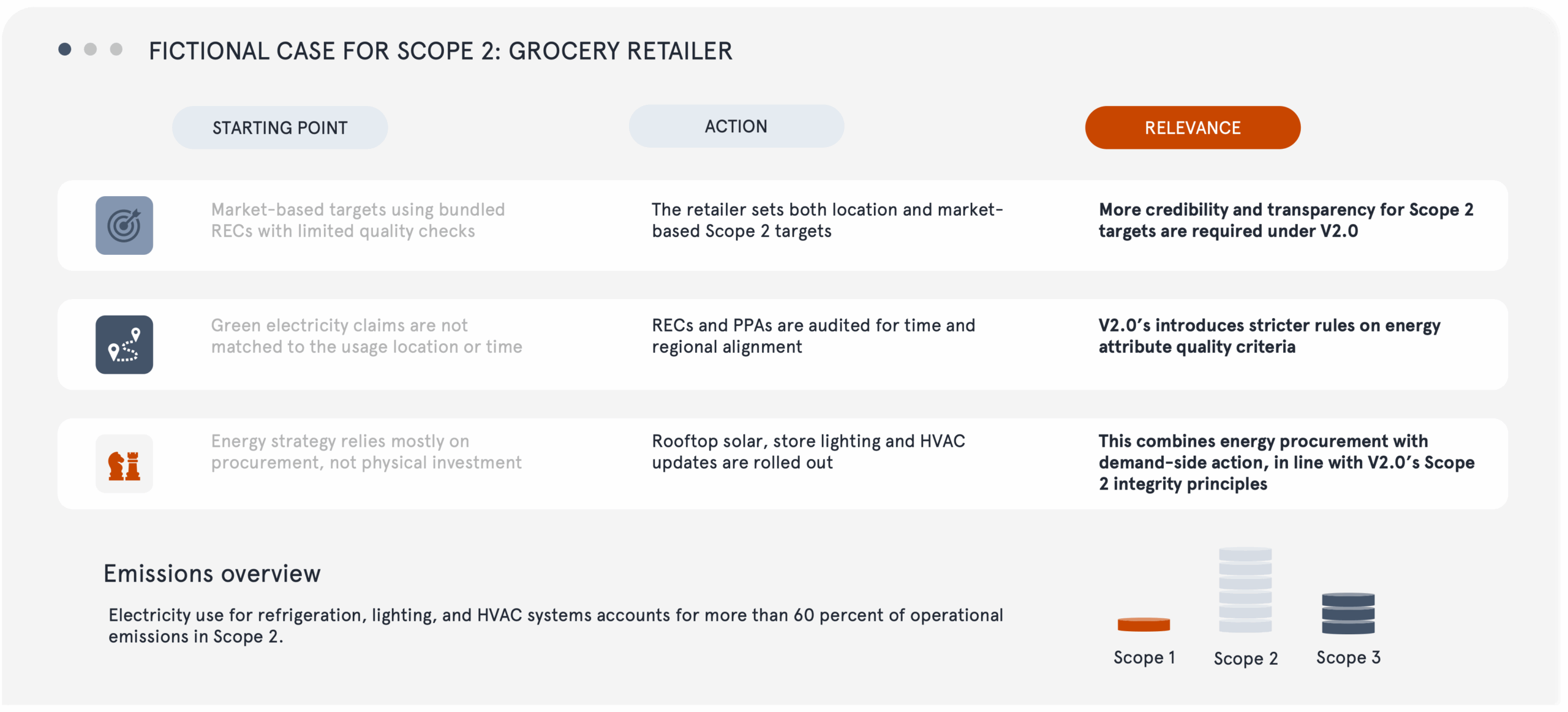

Scope 2: A grocery retailer cutting energy use in stores

A national grocery chain operates over 1,000 stores, distribution centres, and warehouses. Electricity use for refrigeration, lighting, and HVAC systems accounts for more than 60 percent of operational emissions (Scope 2).

Under SBTi V1, the retailer met targets using market-based claims via bundled RECs, without audits on their geographic or temporal relevance. Electrification of heating and delivery fleets is increasing demand further.

Under SBTi V2.0, the retailer must set both location- and market-based Scope 2 targets. Location-based targets reflect the grid mix where electricity is consumed, while market-based targets are based on contractual instruments like RECs or PPAs.

To count toward the market-based target, contracts must now meet stricter quality criteria: clean energy must be generated at the same time it is consumed (time matching) and on the same grid where it is used (geographic matching).

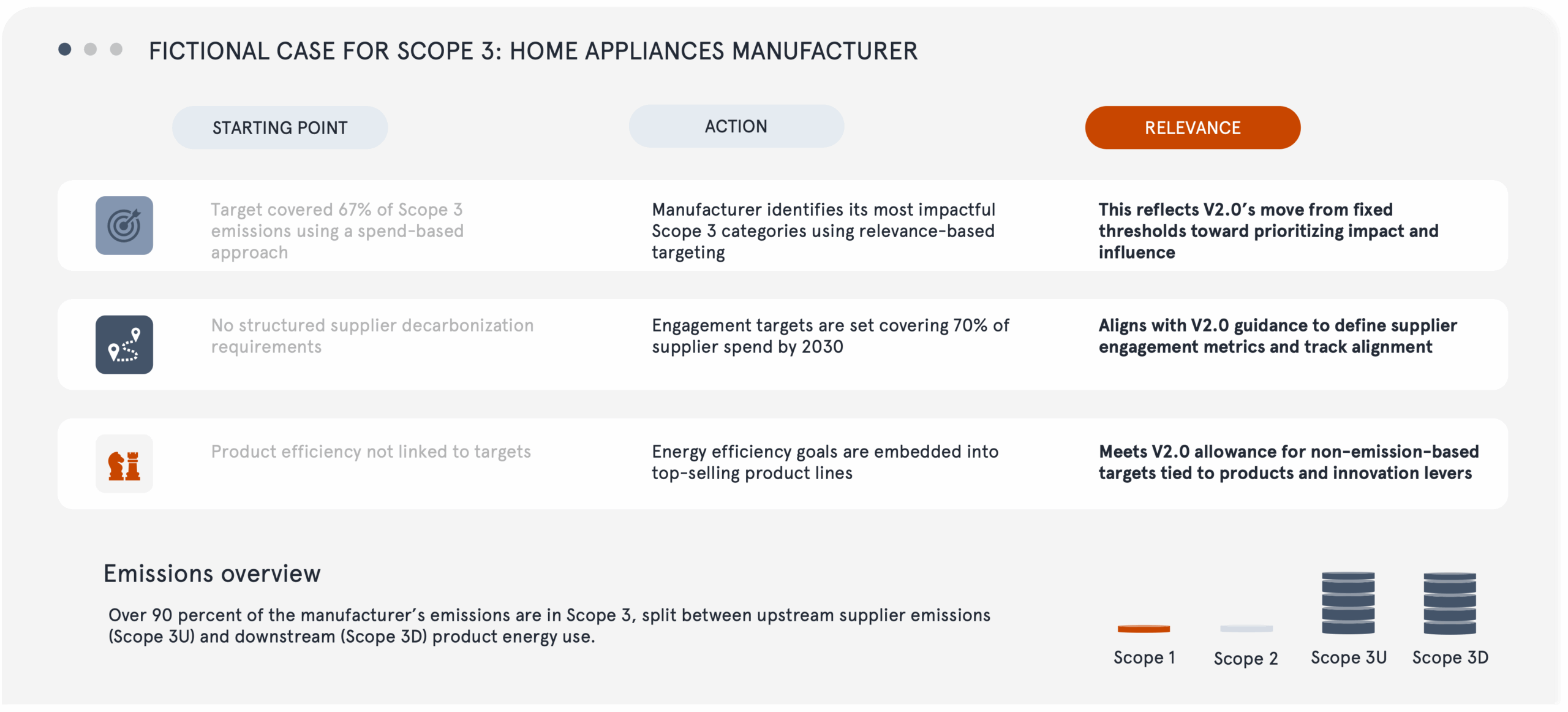

Scope 3: Home appliance manufacturer addressing product and supplier emissions

A global manufacturer of home appliances sells millions of products annually across Europe, Asia, and North America. Over 90 percent of its emissions are in Scope 3, split between upstream supplier emissions and downstream product energy use.

Under SBTi V1, the company covered 67 percent of Scope 3 using broad spend-based targets but lacked targeted supplier engagement or integration of product efficiency.

SBTi V2.0 allows more flexibility while expecting stronger relevance, influence, and traceability in Scope 3 strategies.

Turn ambition into action with Nordic Sustainability

These scenarios show how the V2.0 draft could reshape company strategies across Scope 1, 2 and 3. As the draft remains under consultation, further changes or clarifications may still be made before the final version is released. While it will only take effect starting in 2027, implementing the necessary systems and identifying the correct data takes time, so businesses that prepare early will be best placed to adapt smoothly and maintain credibility.

At Nordic Sustainability, we have extensive experience guiding companies through SBTi target setting. If you want to understand what the draft means for your business and how to prepare, our climate team is here to help.

Start your decarbonisation journey with us.

Reach out to our Climate lead Ole Høy Jakobsen.