A classification with the potential to rule them all…

The European Commission’s EU Taxonomy on sustainable finance came into force in July 2020, and businesses and financial institutions across the continent have been gearing up to report to it. Despite continuous insecurities of technical details: The Taxonomy holds the potential to be the regulatory lever that successfully reorients capital flows towards companies and projects which truly drive the transition to a sustainable economy. Let us explain;

The Taxonomy is, in short, a framework for classifying green corporate activities, and thereby investments into those companies – a longed-for tool to help investors, companies, issuers, and project promoters navigate the transition to a low-carbon, resilient and resource-efficient economy. It aims to create a uniform and harmonised classification system, protect against greenwashing, avoid market fragmentation and provide a basis for future regulation and standards.

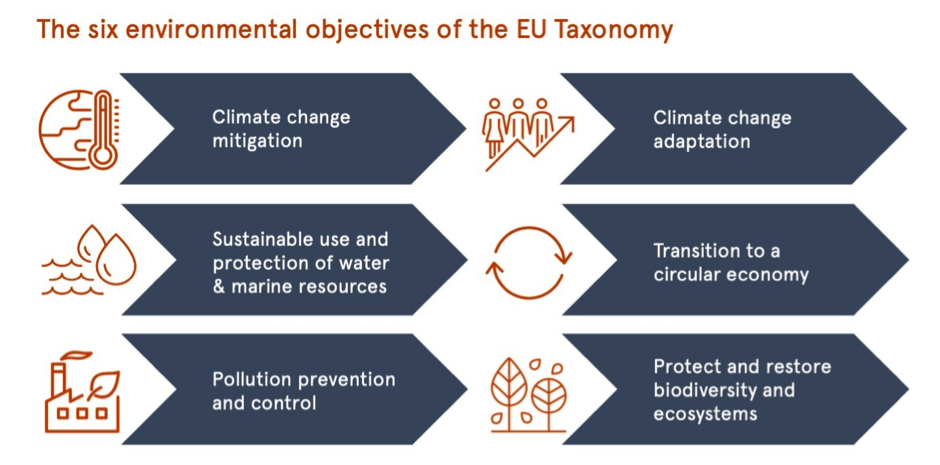

At its core, the Taxonomy sets performance thresholds (referred to as ‘technical screening criteria’) for economic activities to assess if they make a substantive contribution to one of six environmental objectives;

- Climate change mitigation;

- Climate change adaption;

- Sustainable and protection of water and marine resources;

- Transition to a circular economy:

- Pollution prevention and control;

- Protection and restoration of biodiversity and ecosystems.

In addition to this substantive contribution, these economic activities must do no significant harm (DNSH) to the other five objectives.

While environmentally focused, the Taxonomy also stipulates minimum safeguards for human rights and working conditions (e.g., OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights).

Let us be clear on one thing: hidden behind the technical language are two basic ideas, which combined can prove revolutionary:

For one, a systems view is needed, to identify an environmentally sustainable activity. Substantive contributions must not come at the expense of significant negative impact elsewhere, both upstream and downstream value chains.

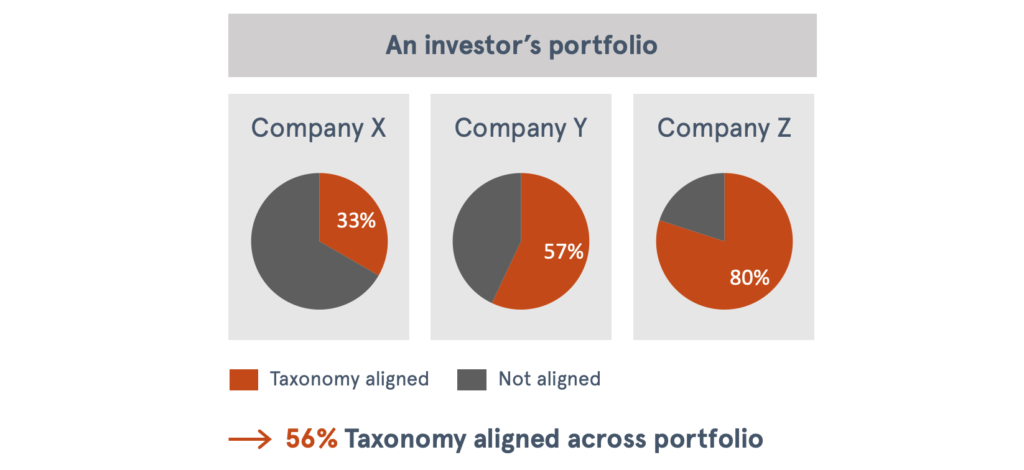

Secondly, taxonomy-aligned company activities must be put in the context of all revenue-generating activities, to understand how coupled business activities and impacts are. To identify the degree to which a company is Taxonomy-aligned, one must revenue weight each distinct activity. A company is not 100% Taxonomy aligned until all revenue-generating activities make substantive contributions to one or more of the stated objectives. By doing so, anything less than full sustainability integration into an organisation’s product and service portfolio will be discouraged.

As such, the Taxonomy should not be interpreted as yet another reporting burden placed on companies. Instead, this is a strategic imperative, an opportunity for companies to understand whether or not their activities can be classified as sustainable, and have a definitive and tangible end goal to achieve in regards to their sustainability performance.

Thereby the taxonomy will not only give businesses, as well as investors a, peek into the current situation, it will also provide incentives to shift the bulk of their economic activities to address one of the six objectives. The EU taxonomy provides the definitive standard to aim for when considering what activity is sustainable.

… which is strongly aligned with the thinking behind the world’s most ambitious sustainability management framework

No less ambitious, and driven by a foundation rather than the public sector, The Future-Fit Business Benchmark has been around since 2015 and is a strategic management tool for companies and investors to assess, measure and manage the impact of their activities, both positive and negative.

At its core, the Benchmark is a systems-focused, forward-looking framework that identifies business-specific social and environmental thresholds, and offers information, insights, and actionable steps a company can take to measure and make progress toward them.

In addition, the Benchmark is a framework for identifying, measuring, and communicating positive contributions, including the extent to which contributions are coupled with revenue-generating activities.

Where the Taxonomy defines an environmentally sustainable activity, the Benchmark defines a truly sustainable company. As such, the Benchmark fully encompasses the six environmental objectives, the minimum social safeguards, and additional social or environmental considerations that stakeholders and future regulators are likely to pay attention to.

This puts companies in a position to pro-actively manage and respond to both current and future societal and regulatory pressures, while also providing the mechanism through which to communicate its contributions and trajectory towards climate change mitigation and adaptation, circularity, resource stewardship, and social and planetary wellbeing.

Future-Fit is at the cutting edge in developing a simple, meaningful and effective approach that will help define the next generation of extra-financial data reporting – Virgin Money

Using the Future-Fit Benchmark to prepare for EU Taxonomy disclosures

The EU Taxonomy has got investors racing to get the methodologies and systems in place to analyse their portfolios and provide the required data to the Commission. While exact requirements on what to report and how to do so are still being finalized by the EU’s expert group on sustainable finance, it is clear that companies and investors need to start preparing now.

The Future-Fit Business Benchmark can help by:

a) Identifying and closing data gaps.

b) Integrating current ambitions, be it Taxonomy alignment, SDG alignment or B-Corp certification, into one unifying vision.

c) Offering access to a community of progressive companies, investors and experts, offering insights and sharing best practices.

By working with the Future-Fit Benchmark, companies can therefore start today to stress-stress their strategies and create the baseline data they will be requested to report on tomorrow.

Even for those [companies] who do relatively well, the systemic perspective has opened our eyes to the fact that we have some blind spots and negative impacts – Susanne Stormer, former VP Corporate Sustainability at Novo Nordisk

Being ahead of the curve now – to avoid potential business disruption in the future

No company wants to be disregarded by investors because it fails to capture and communicate its contributions, and surely no investor touting the sustainability focus of its work wants it to be revealed that a certain portfolio may not actually be all that sustainable.

Detractors may argue that there is still a lot of uncertainty on what the specific requirements will be. And they have a point, as the transformational potential of the Taxonomy hinges on two key issues that remain to be fully defined:

1. How quickly the Taxonomy covers sectors that are not currently part of the Taxonomy (Aviation, etc.)

2. How the Taxonomy ensures that the mechanism for ensuring thresholds for “green” activities will be tightened rapidly enough to support the transition.

We would argue, however, that the flexibility around these issues is what makes the Taxonomy politically viable in the first place. In the current political climate, and given that many solutions have not been developed or commercialised yet, creating a mechanism that expands and strengthens over time makes sense.

What also makes sense is for companies and investors to start the journey now. In our experience, it is easy to underestimate the scale of the transformation needed to make a company sustainable across the board. And this transformation is crucial for successful businesses in the future, as the upcoming Taxonomy regulation risks stranding under-performing companies on sustainability. Asking yourself the following question is a useful way to understand why it is so crucial to be ahead of the curve: if tomorrow, a competitor was able to provide your product or service in a sustainable way, how would that affect your business?

The time to start transforming your company is now, and The Future-Fit Business Benchmark provides one of the best ways of managing your transformation.