The EU’s new Corporate Sustainability Reporting Directive – or what you might know as the CSRD – has the potential to become a real game-changer for sustainability reporting.

Already next year, companies will be expected to start adapting to the new requirements, so it’s high time to make sure your business is ready for what’s to come. Still not sure what exactly the CSRD is, how it works, and who’ll be affected by it? No need to panic – we’ll go over the details below.

Why is sustainability reporting important?

As many already know by now, we need to halve our emissions by 2030 if we are to adhere to the Paris Agreement’s necessary goal of limiting global warming to 1.5 degrees. The EU has with the Green Deal demonstrated that they are taking the agreement seriously, setting targets such as reaching net-zero CO2 emissions by 2050, and reducing current emissions by 55% by 2030.

To make 1.5 degrees and the ambitions of the Green Deal a reality, €1 trillion are needed. But there is a long way to go, as according to a recent report by the World Resources Institute (WRI), the world’s current modus operandi will bring us nowhere close to where the EU wants us to be within the next couple of decades. At the moment, not a single industry is on track, and the WRI estimates that the finance sector alone needs to ramp up public and climate finance 13 times faster.

This is where the CSRD comes in. Having a standardized sustainability reporting system in place is crucial if we are to take climate finance seriously, as it will allow investors to adequately benchmark and compare sustainability performance and impact across industries. This, in turn, will help them make better and more informed decisions when investing. In the past, the focus of investors has almost exclusively been on a company’s financial performance. However, in recent years it has become increasingly clear that sustainability is an important indicator of a company’s current as well as long-term success.

Lastly, to avoid drowning in a sea of different ESG rating systems, having a main reporting standard to lean on is key. With standardization also comes transparency, making the unacceptable practice of greenwashing more difficult.

What is the CSRD and who will be affected?

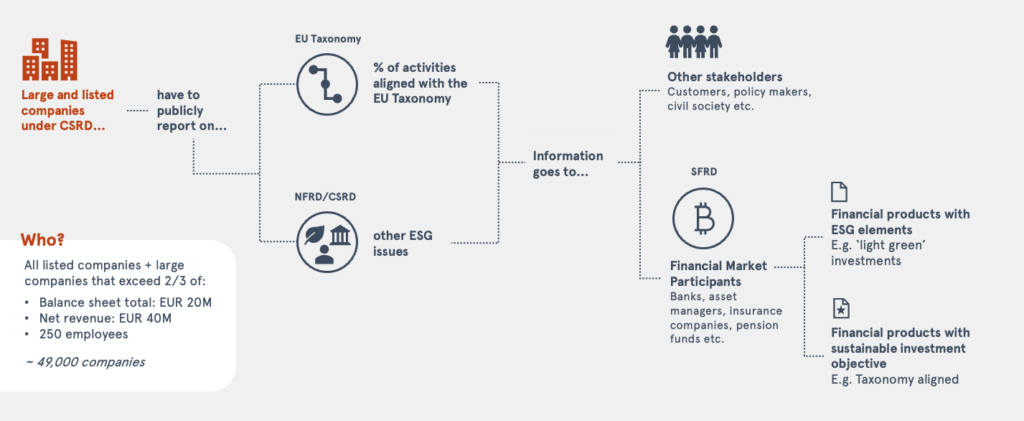

The CSRD is a compulsory reporting directive on ESG issues, aiming to create transparency and to channel funds towards sustainable activities. Over 49,000 companies will be affected by the CSRD; this includes all listed companies (including SMEs), as well as large enterprises that exceed two-thirds of the following: 1) a balance sheet total of €20M; 2) a net revenue of €40M; and 3) 250 employees.

Similar to financial reporting, third-party auditing will be required under the CSRD. The information that companies have to report on will also need to be digitally tagged to enable comparisons. While we do not know the exact details yet, some areas that companies will need to report on include:

- Strategy and business model

- Future scenarios

- Targets, progress, and KPIs

- All processes on due diligence

- Value chain, including suppliers

- Role of management

- How information was identified

How does the CSRD link to the EU Taxonomy and other already existing legislation?

The CSRD builds upon the Non-Financial Reporting Directive (NFRD), which requires companies to report on both how sustainability issues affect their business, as well as on how their own activities impact people and the environment. In July this year, however, the Commission proposed a revision of the Directive – namely, the CSRD. The reasons being, that the information that companies currently need to report on under the NFRD has proven to not only be insufficient, but also lacking in quality, and making sustainability comparisons difficult. What all of this means in practice, is that when the additional requirements of the CSRD will enter into force, the ones under the NFRD will continue to be valid.

Another linkage between the CSRD and already existing EU legislation, is its connection to the SFDR – Sustainable Finance Disclosure Regulation – regulation on sustainability-related disclosures in the financial services sector. This piece of legislation governs how financial market participants should disclose sustainability information to end investors and asset owners.

Finally, companies need to be aware of the CSRD’s connection to the EU Taxonomy Regulation, which classifies environmentally sustainable activities. The taxonomy, which currently also is undergoing further development, requires NFRD/CSRD companies to disclose certain indicators about the extent their activates are environmentally sustainable according to the taxonomy. For companies in scope, it is set to gradually trigger additional non-financial reporting requirements as of financial year 2021. These new developments will allow investors and other stakeholder to rely on more precise definitions for economic activities that are considered environmentally sustainable. For more information about the EU Taxonomy, watch our webinar here.

When will all of this be put into effect?

In mid 2022, the European Parliament and the Member States in the Council are expected to negotiate a final legislative text on the basis of the first proposal of the CSRD, which was made public by the Commission in July this year. By the end of 2022, the Commission should then be able to adopt the first set of reporting standards under the new legislation. On January 1, 2024, large and listed companies should be able to apply the standards or the first time to reports published in 2024, covering the financial year of 2023. At last, in 2026, remaining companies – such as SMEs – are expected to apply the standards.

Although important to keep track of, it is worth noting that legislative deadlines do not always accurately reflect reality. 2024 might seem far away, but in fact, financial market players have already started showing an interest in receiving CSRD-related data from companies.

How companies can get ready for the CSRD

Peter Gylling Krusaa, Senior Lead Regulatory Advisor at Ørsted, has provided us with some valuable insight on what companies can do to prepare for the new requirements of the CSRD, drawing on his experiences in Ørsted. We’ve summarized his advice below:

- An interdisciplinary effort will be required. “There is a high level of technical detail, which is a though challenge because it requires so many areas of expertise to work together,” says Peter. In practice, this means that companies will need many of their departments involved in the process – having just one department deal with it simply won’t be enough. He adds: “You have to put these ESG matters on an equal footing with your financial reporting. Otherwise, you will not be able to do the job properly.”

- The timeline is ambitious – get cracking on it as soon as possible. Peter says: “It takes a lot of time to assess your business up against these rules, because they are so detailed. Besides, you also need to think about your suppliers. You better be on this as soon as possible, if that’s not already the case.”

- Remember that third-party verification will take place. “Up until now, many of these CSR and ESG issues have been up to yourself to evaluate. And of course, some companies have been nice to themselves,” Peter mentions. The CSRD with its third-party verification adds another layer of seriousness to the new reporting standard. “Remember that you will actually be checked in the end,”, he points out.

- Exchange knowledge and learnings with peers. For few, the process of adapting to the new reporting guidelines will be completely free from obstacles. “I recommend creating some common understanding with peers or via industry associations, as there will always be blurred and unclear matters,” Peter says.

Re-watch our webinar on the CSRD In our webinar from November 2nd, our colleagues Maja Johannessen and Esben Lanthén from Nordic Sustainability guide you through recent developments in sustainability reporting, as well as the implications that these will have for businesses. With us is also Peter Gylling Krusaa, Senior Lead Regulatory Advisor at Ørsted, who provides valuable insights on how these new developments can be applied in practice. Watch the recording here:

Re-watch our webinar on the CSRD

In our webinar from November 2nd, our colleagues Maja Johannessen and Esben Lanthén from Nordic Sustainability guide you through recent developments in sustainability reporting, as well as the implications that these will have for businesses. With us is also Peter Gylling Krusaa, Senior Lead Regulatory Advisor at Ørsted, who provides valuable insights on how these new developments can be applied in practice.