November 2022 is shaping up to be an exciting month in the sustainability reporting space. Last week, the Corporate Sustainability Reporting Directive (CSRD) was approved by the European Parliament, which will significantly raise the bar on corporate sustainability reporting.

Later this month, the Council is likewise expected to adopt the directive.

But that’s not all – any day now, we also expect to see the updated European Sustainability Reporting Standards (ESRS) published, as EFRAG (short for the European Financial Reporting Advisory Group) is set to deliver the updated sector-agnostic drafts to the European Commission by mid-November.

As we wait for the updated ESRS to be made public, let’s revisit what we know about the standards to date – and the likely implications for companies.

We’ve put together five frequently asked questions, that we’ve dug into together with our clients since the draft standards were made public in April. There’s a lot to wrap your head around when it comes to 400 pages of disclosure requirements, so buckle up!

1. How extensive are the new reporting requirements on ESG matters?

The ESRS are the most comprehensive package on sustainability reporting to date. Building on known frameworks such as the GRI and the TCFD, the standards aim to consolidate known disclosures, while also going beyond these. Even the companies with the best data sets in place today will have a long compliance and data collection journey ahead of them.

The ESRS are highly comprehensive in scope and the April draft standards were categorized into four areas:

- Cross-cutting: General principles and General, strategy, governance, and materiality assessment

- Environment: Climate change, pollution, water and marine resources, biodiversity, resource use and circular economy

- Social: Own workforce, workers in the value chain, affected communities, consumers, and end-users

- Governance: Governance, risk management, internal control, and business conduct

The updated drafts are expected to be less comprehensive in scope than the April versions and in a recent EU side-event at COP27, EFRAG shared that the revised standards likely will contain approx. 40% less data points than the April drafts. That said, if the breadth of themes stays more or less consistent – along with the expectation to report impacts across your value chain – then even the most advanced companies will still have their work cut out for them in terms of not only collecting the necessary data, but also managing the identified impacts in a credible way.

Next year, sector-specific requirements are also expected, adding to the granularity of requirements.

2. How quickly will this all come into play?

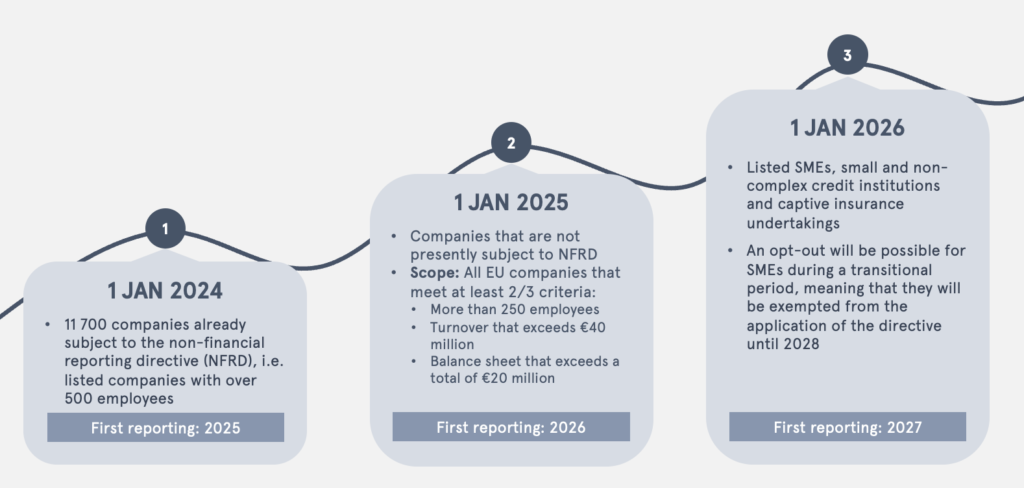

Companies will be subject to new regulation in different waves, beginning with the 11 700 companies already subject to the old Non-Financial Reporting Directive (NFRD). These companies have only a little over a year remaining, before reporting structures need to be in place for data gathering throughout 2024 and first reports in 2025. Once the second batch of large EU companies are required to report in 2026, CSRD will cover approximately four times as many companies as the NFRD did.

Listed SMEs will be required to report in 2027 (or opt-out until 2028). Some smaller companies may already begin to feel the demands of ESRS in the next year or so, since the more advanced larger companies will begin collecting data from suppliers ahead of their first reporting year. Toward the end of this decade, certain non-EU companies will also be subject to CSRD, expected to cause a well-needed push to the sustainability reporting landscapes outside of the EU’s borders.

3. Do the ESRS trigger any significant shifts in the corporate sustainability sphere?

The ambition from the European Commission is clear: The aim is to trigger a significant paradigm shift in the sustainability reporting space, and to put environmental, social, and governance topics on equal footing with financial reporting.

It will also trigger a need for companies to revisit their current sustainability strategies: Companies will need to start addressing strategically far more impacts, risks and opportunities than they are doing today, once they start working systematically with ESRS.

Here are some of the key shifts to current reporting practice we also expect the revised standards to contain, based on what EFRAG and the European Commission has communicated publicly and repeatedly so far:

- Double materiality cemented as the “go to” approach, meaning companies must report not only on their environmental and social impacts, but also disclose how these translate to financial risks and opportunities for the company.

- Actual impact reporting is in focus: Rapid data capacity expansion is needed across all companies to document impacts and progress

- Value chain is now a part of the reporting scope in a highly comprehensive manner (although it remains to be seen if the revised standards will include any limitation to supplier tiers)

- Link between (negative and positive) sustainability impacts and the company’s strategy & business model needs to be made more clear

- Stakeholder understanding broadens significantly: Companies need to begin engaging with affected stakeholders in a more systematic and transparent way

4. What’s next for companies?

The days of simply assessing companies on financial performance are now long gone. With these new requirements, even the companies that have set science-based targets, have a good CDP rating, and are reporting according to GRI will need to step up.

To get on the right track to ESRS compliance, companies should begin with a data gap analysis to assess their readiness to report on specific ESRS disclosure requirements across all ESRS sector-agnostic standards. Once an initial understanding is formed, companies should then assess material impacts, risks, and opportunities in line with the double materiality principle required by ESRS.

5. I need more information – what should I look for?

Keep your eye out for more updates, as EFRAG is expected to submit their revised ESRS drafts to the European Commission mid-November. The standards are then set to be approved no later than June 2023. During next year, we also expect to learn more about the sector-specific standards and what dimensions these add to the bigger picture.

In Nordic Sustainability, we’ll also be examining the revised ESRS drafts closely once these are published, so make sure to sign up for our webinar on December 8th, where we will take you through some of the key changes in the new standards text and what these changes mean for companies. The webinar event link will be posted on our LinkedIn page later this week – so stay tuned!

Want to know more?

If you have questions on the topic, please fill out our contact form with a note for Emma Tatham or Anniina Kristinsson, and one of us will get back to you soon.