It’s finally time for another review of a book that we’ve read as part of our Nordic Sustainability book club. This time, we’ll talk about Green Swans: The Coming Boom in Regenerative Capitalism by John Elkington – the “Godfather of Sustainability” himself.

In his twentieth book, Elkington optimistically explores new forms of capitalism fit for the twenty-first century, and the critical role that businesses play in solving what the author refers to as “wicked” problems – such include plastics in the ocean, obesity, and climate breakdown. Let’s begin by diving into the situation humanity is finding itself in today, and why Elkington argues that a system transformation is urgently needed.

Today’s capitalism is broken

Elkington refers to the 2020s as “the exponential decade” – a decade in which wicked and super-wicked problems, such as the ones mentioned above, will grow at a rapid rate. He further predicts that we currently are heading towards the very depths of a sort of historic U-bend, soon entering a period of maximum uncertainty. How this phase plays out in practice, is that currently dominating ideologies and systems will be put under increasing pressure. Elkington questions whether democracy, sustainability, and capitalism can coexist, and comes to the conclusion, that – most likely – capitalism, as we know it today, will crash and burn, only to later reemerge as a less degenerative version of itself.

To speed up the journey towards this upgraded, regenerative form of capitalism, we need to embrace uncertainty, and dare to experiment with new economic and political models. In Elkington’s words, “we must move well beyond the development of new frameworks and tools, and towards new thinking, and critically, toward new operating systems for our economies.” Furthermore, he advises to use the United Nations’ Sustainable Development Goals as a North Star to guide the way forward.

While he foresees that in a couple of decades, people will remember today as a painful and demanding period, he remains refreshingly optimistic about the promising opportunities that lie at our feet.

“I think it is an immense challenge, but at the same time, an immense opportunity. I can’t think of when I’ve been quite so excited.” – John Elkington

Black, grey, and green swans

So what sort of system changes are desirable, and what defines them? This is where the notion of the green swan comes into the picture. But first, to understand its context, we should look to its counterpart: the black swan.

Elkington expands on Nassim Nicholas Taleb’s concept of the black swan, which characterizes a rare, unpredictable event with large-scale negative impact. A typical question after the emergence of a black swan is: “How did we not see this one coming?”. The closely related grey swan sports the same characteristics, but differs in the way that it is just likely enough to be anticipated by some. The concept of black and grey swans have significantly impacted how we think about risk.

Green swans, similarly, are events that take the world by surprise (or most of it – as they, also to some extent, can be foreseen). Often, they emerge as a response to previous black or grey swans. What differentiates the green swan from its darker cousins, however, is that it triggers positive exponential change, building resilience and bringing us closer to a regenerative breakthrough.

Important to note though is that green swans aren’t always 100% green – there are instances, in which they can sprout black feathers. Take for example electric vehicles, one of Elkington’s examples of a prominent green swan trajectory. But due to their dependency on batteries, which, in turn, require problematic metals such as cobalt, electric vehicles cannot be considered the purest of green.

How we can create green swan dynamics

We firmly stand by Elkington’s perspective that businesses play a deciding role in supporting and accelerating the evolution of emerging green swans, who in turn will solve the most critical challenges humanity is faced with today.

Aware that this might sound like a daunting role to take on at first, a promising open-source movement that the author encourages all firms to look into is the work of the Future-Fit Foundation (who Nordic Sustainability are also proud accredited partners of). The Foundation holds a real promise when it comes to the area of system change, and Elkington sees that it even has the potential to evolve into a global operating system for business, markets, and perhaps even cities and governments.

Three critical observations about how the global economy currently is failing us underpin the Future-Fit Foundation’s strategy:

- We are disrupting and degrading Earth’s natural processes, upon which we as a species and all other life depend.

- The basic needs of billions of people around the world are far from being met.

- While governments and public sector agencies can set all the goals and targets that want, only business has the power to address these critical challenges at the scale and pace needed.

So how can companies contribute to tackling these deep-rooted issues? The secret lies in rethinking how long-term business value and wealth is defined and created. Companies don’t exist in their own bubble – in fact, business can only truly thrive if society does so, too. In the long-term, social and environmental issues also become financial issues.

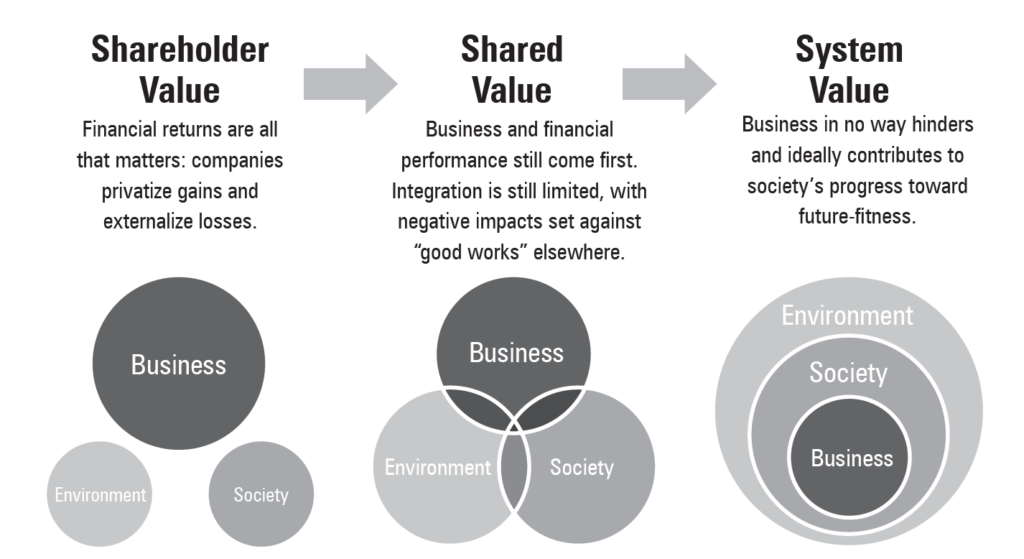

The ‘shared value’ model that you see in the image below, resembles how many companies interpret the famous Triple Bottom Line – a concept Elkington himself introduced in 1994. However, nowadays convinced that a more holistic approach (as represented in the ‘system value’ model) is the only true way forward, he has distanced himself from the Triple Bottom Line, and has even gone as far as recalling the concept.

In essence, it is the ‘system value’ model that will best enable green swan dynamics. Hence, moving towards such a model must be a priority for businesses, if they are to be part of leading the change.

As Elkington sums up: “Companies must be willing to disrupt the status-quo, or wait to be disrupted.”

Which do you choose?