On October 1, Nordic Sustainability hosted a webinar on how companies can turn climate risk into a source of competitive advantage. The discussion moved beyond compliance, exploring why climate risk belongs at the core of business strategy, how to approach scenario analysis and how organisations can integrate insights to strengthen resilience and create long-term value.

The panel featured Sven Beyersdorff, Managing Partner at Nordic Sustainability, Freddie Baker, Climate Risk Senior Consultant and Ottilly Mould, Senior Manager and Climate Risk Lead at Nordic Sustainability.

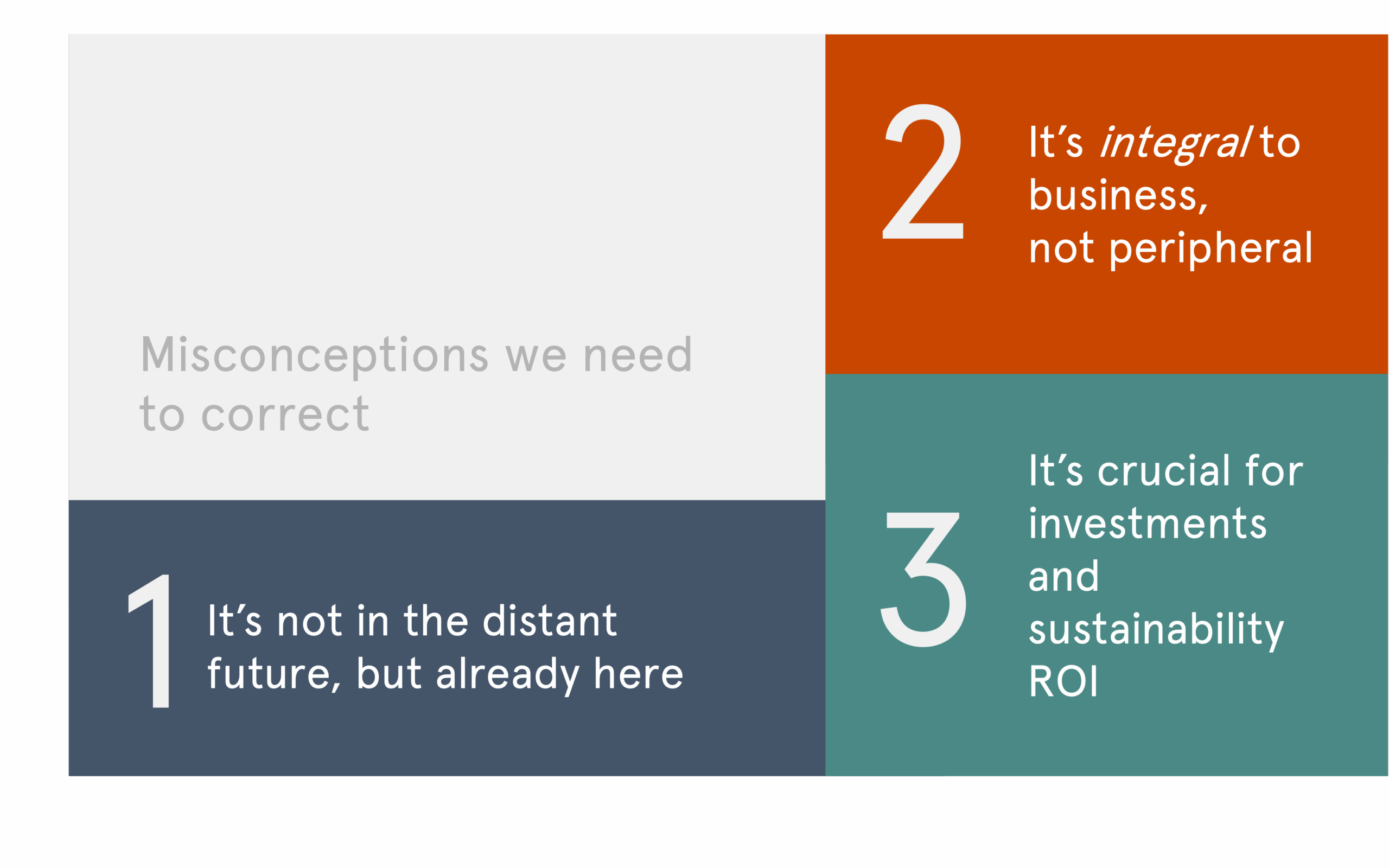

Climate risk is inherently misunderstood and undervalued

Opening the session, Sven Beyersdorff set the scene: climate risk is not a distant threat. Droughts and extreme weather have already disrupted commodity markets, driving cocoa prices up 300% in 2024 and olive oil prices up 50% in 2023.

The financial sector is also reacting. Insurers in the US have stopped offering coverage in certain high-risk areas, illustrated by how insurance policies were cancelled in Los Angeles just before the 2025 wildfires.

Globally, natural catastrophes are already driving $100 billion in annual losses, leading insurers and financial institutions to embed climate risk into their models. The European Central Bank, for example, recently announced that climate factors will be integrated into its collateral framework. For businesses, this means climate risk will increasingly become part of capital raising conversations.

From the periphery to the core of business strategy

Sven argued that many companies still treat climate risk as a side issue, often limited to high-level side-of-the-desk analyses and annual disclosures. But as science, data, and methodologies advance, the limitations of this “tick-box” approach are clear. Climate risk, he stressed, goes to the foundation of business models:

- Rising input costs and volatile commodity markets can quickly outstrip profit margins.

- Shifting consumer preferences may challenge entire product portfolios.

- Failure to adapt to technology transitions, as illustrated by Volkswagen’s delayed EV shift, can erode competitiveness and market share.

In this context, climate risk should not be seen as peripheral. It is integral to business continuity, market positioning, and long-term value creation.

Rethinking investments and time horizons

A final point Sven emphasised was the mismatch between short-term business planning and the long-term nature of climate disruption. Many companies work with three- to four-year ROI horizons, but major climate impacts are likely to occur within six to eight years. By sticking to business-as-usual investment logic, companies risk under-preparing for disruption.

Climate risk 101: physical and transition dimensions

Freddie Baker built on Sven’s framing by introducing the underlying theory behind climate scenario analysis (CSA) and why it is different from traditional risk assessments. Climate risks are more complex, more uncertain, and more nuanced than conventional business risks, and they require new language and approaches.

Two categories of risk

Freddie distinguished between two main “buckets” of climate-related risk:

Physical risks: These are the tangible impacts of a warming climate, such as floods, heat stress, droughts, and wildfires. Physical risks tend to escalate with higher warming scenarios. In a world beyond 3°C, these risks multiply, affecting both company assets (sites, offices, employees) and supply chains (production, logistics, and distribution).

Transition risks: These stem from the policies, markets, technologies, and reputational shifts required to create a low-carbon economy. In contrast to physical risks, transition risks are greater in a 1.5°C world, since achieving this requires profound structural changes.

CSA helps organisations identify value at stake and quantify the potential financial impact of climate hazards.

Key features of CSA include:

- Testing different warming pathways, from >3°C to 1.5°C, to capture the full spectrum of possible futures.

- Considering long time horizons, often extending to 2100, rather than limiting analysis to short-term business cycles.

- Assessing materiality by combining exposure (how directly a business is affected) with vulnerability (its capacity to adapt).

While reporting regulations such as CSRD, TCFD, and IFRS S2 require basic levels of CSA, Freddie argued that the real benefit comes when companies move beyond compliance and use CSA for strategic decision-making.

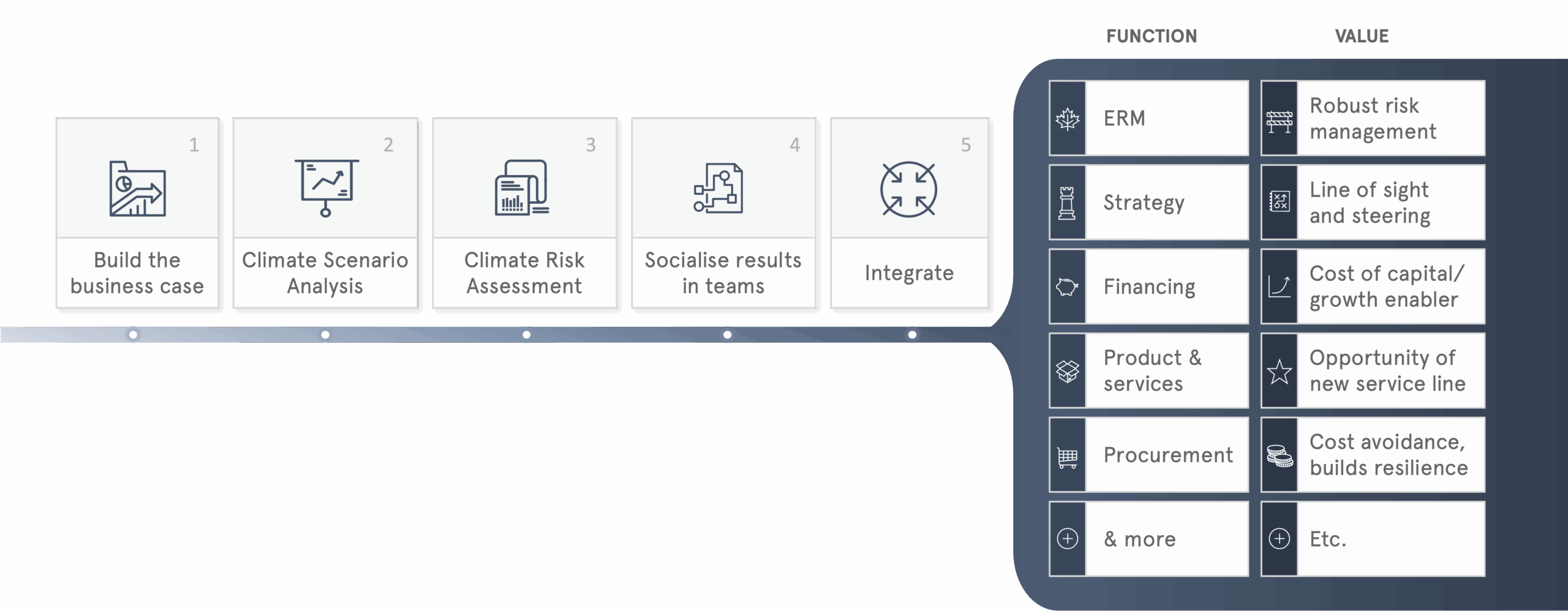

How to move from risk to value

Ottilly Mould noted that as climate risk assessments become mandatory in more jurisdictions and are increasingly requested by financiers, many companies will soon be required to undertake them. Rather than a light-touch, compliance-driven assessment with limited value, companies should invest in doing it properly and integrating it into the business to reap the rewards.

When embedded into core processes, climate risk moves from being a reporting exercise to becoming a genuine source of competitive advantage.

Five areas where integration is most critical

ERM: embedding climate risk into enterprise risk management ensures accountability and monitoring so that quick and appropriate action can be taken.

Strategy: scenario analysis future-proofs strategic plans against rapidly shifting technologies and markets.

Financing: investors and banks are beginning to price in climate risk, influencing access to capital.

Products and services: aligning innovation with low-carbon futures avoids stranded assets and creates new opportunities.

Procurement: resilient supply chains require factoring in both geopolitical and physical climate risks.

Challenges of integrating climate risk into these functions

Integrating climate risk into organisations is not without challenges:

- Different time horizons between business planning (3–5 years) and climate science (up to 2100).

- Limited availability and quality of decision-ready data.

- Tensions between short-term profitability and long-term resilience.

Ottilly acknowledged that there is no single “silver bullet” for integrating climate risk effectively. Instead, companies need a mix of approaches tailored to their specific context. From her project experience, she highlighted three key lessons:

1. Build capacity

Climate risk is a technical topic that introduces a new language and way of thinking for many employees. For example, the implications for procurement look very different from those for product development. Translating results into each team’s context helps people understand not only the risks but also the opportunities, creating motivation and energy to act.

2. Build the business case

Once risks and opportunities have been identified, organisations need time, budget, and willingness to take action. Quantification is essential here: assessing the cost of inaction versus the cost of mitigation, or the value of launching a climate-resilient product. Although modelling remains complex and lacks standardisation, quantification is quickly becoming a core expectation for gaining leadership buy-in and securing resources.

3. Ensure decision-ready data

Public climate data is improving, but internal data remains a challenge. Companies need to start collecting information on consumer preferences, material substitution costs, and new market entry risks. While gathering this data is difficult, once in place, it enables much faster, better-informed decisions.

Examples of companies that have integrated climate risk in parts of their organisations

The panel shared concrete examples of companies that are turning climate risk into opportunity:

- AstraZeneca redesigned inhalers with low-emission propellants, mitigating regulatory risk while launching a new product.

- Dow integrated bio-based feedstocks into plastics, reducing reliance on fossil fuels and capturing demand for sustainable alternatives.

- IKEA reshaped global logistics by shifting routes to rail and nearshoring production, cutting both disruption risks and emissions.

Ready to get started?

At Nordic Sustainability, we help organisations integrate climate risk into strategy, operations, and investment decisions. To learn more, contact Ottilly Mould, Senior Manager and Climate Risk Lead.