Conducting sustainability due diligence is first and foremost about respecting people and protecting the environment, but it also makes sound business sense. It enables smarter decision-making and supports long-term value creation.

By identifying human rights and environmental risks early, companies can prevent costly disruptions, improve supply chain visibility, and stay ahead of evolving legal requirements. A proactive approach that helps build resilience, manage risks more effectively, and foster lasting trust.

However, most businesses still struggle to implement effective due diligence, especially when addressing human rights1. This explainer outlines the key components of a due diligence framework and offers practical guidance to help you take the first steps.

Firstly, what is due diligence?

Sustainability due diligence is not a one-off checklist – it is a continuous, structured process that businesses follow to identify, prevent, mitigate, and account for actual and potential adverse impacts on people and the environment. This process applies across a company’s own operations, value chains, and business relationships, and is designed to be ongoing, risk-based, and responsive to changing circumstances.

Unlike legal or transactional due diligence, which is often tied to specific events like mergers or acquisitions, sustainability due diligence is integrated into day-to-day business conduct. It focuses on risks to people and the environment, not just risks to the company, and follows a set of internationally recognised steps, as set out in the OECD Due Diligence Guidance for Responsible Business Conduct2.

The legal evolution of corporate due diligence

The UN Guiding Principles on Business and Human Rights (UNGPs) and the OECD Guidelines for Multinational Enterprises are complementary frameworks that promote corporate sustainability due diligence. The UNGPs outline broad principles on business and human rights, while the OECD Guidelines provide more detailed recommendations for responsible business conduct. Although all UN Member States have endorsed the UNGPs, they are not legally binding and do not impose enforceable obligations on governments or companies.

Over time, the limitations of this voluntary approach have become increasingly evident. Incidents such as the 2013 Rana Plaza factory collapse in Bangladesh – alongside other serious human rights and environmental abuses – highlighted the risks of relying solely on self-regulation. These events helped build momentum for stronger, binding measures. In response, the European Union adopted the Corporate Sustainability Due Diligence Directive (CSDDD) in 2024. This legislation requires over 5,000 EU companies and approximately 900 non-EU companies operating in the EU to carry out human rights and environmental due diligence3.

Due diligence is now central to a broader set of EU rules that directly or indirectly require companies to embed responsible practices into their operations. Alongside the CSDDD, it is legislation and regulation such as the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy for Sustainable Activities, the EU Deforestation Regulation, and the Forced Labour Regulation. These measures are designed to be interlinked and replace the patchwork of different national laws within EU, ensuring a more consistent, coherent and efficient approach to corporate responsibility. Together, they mark a clear move from voluntary guidelines to enforceable standards.

While the EU Omnibus proposal introduces some key amendments to the CSDDD, most of the proposed changes relate to reporting requirements under the CSRD. Crucially, the core due diligence obligations remain intact – solidifying its role as a cornerstone of the EU’s sustainable governance framework. In fact, for the CSDDD specifically, the scope of in-scope companies and the vast majority of its requirements – around 95% – are expected to remain unchanged. Therefore, early and thorough preparation remains highly relevant to help companies align with the directive’s objectives and integrate due diligence effectively into their operations.

5,000 EU companies and 900 non-EU companies are in scope of EU’s due diligence regulations.

The OECD 6-Step Due Diligence Framework

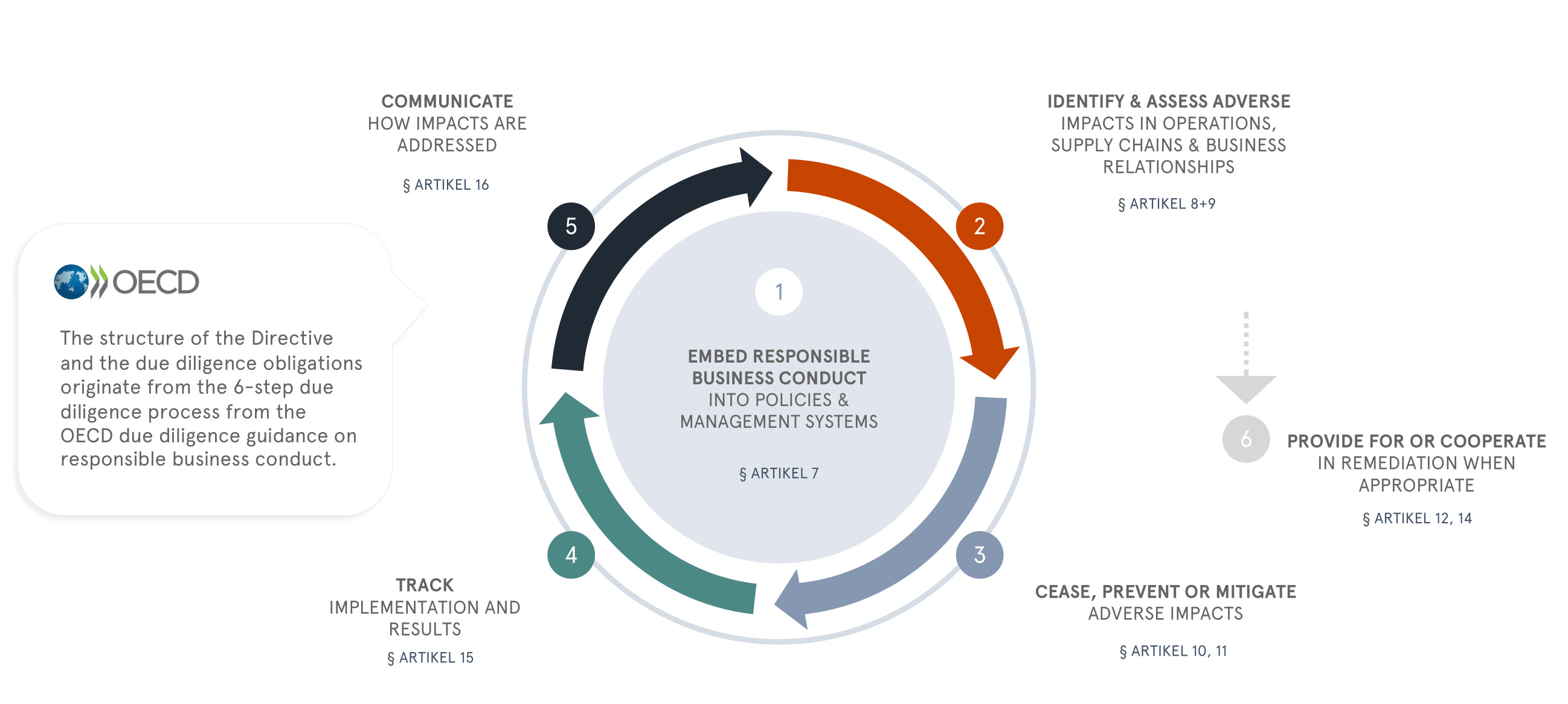

The OECD Due Diligence Guidance for Responsible Business Conduct, which supports the implementation of the OECD Guidelines for Multinational Enterprises, provides a clear and practical due diligence framework. At the heart of this guidance is a six-step due diligence model, illustrated as a wheel – and for good reason.

Due diligence is not a one-time task or a static checklist; it is a continuous, dynamic process. Each step naturally leads to the next, while insights from implementation feed back into earlier stages. The wheel symbolises this ongoing cycle of improvement and accountability, helping businesses remain responsive as risks, expectations, and operating environments evolve.

The EU Corporate Sustainability Due Diligence Directive (CSDDD) also reflects this structure, as seen in the alignment of its key articles with the OECD’s six-step approach.

Here’s a quick overview of the six steps:

1. Embed responsible business conduct into policies and management systems

Begin with a strong foundation. Develop and integrate clear policies aligned with international standards and/or relevant legislation into the company’s systems, processes, and culture—from top-level governance to day-to-day operations.

2. Identify and assess risks

Map your operations and value chains to identify potential or actual adverse impacts on people, the environment, and society. The goal is to know where risks are most severe and most likely to occur.

3. Cease, prevent, or mitigate risks

Once risks are identified, take meaningful action. This might involve changing practices, ending harmful activities, or working with partners to improve conditions.

4. Track implementation and results

Monitor how effectively your actions are working. Use measurable indicators, audits, or feedback loops to understand outcomes and drive continual improvement.

5. Communicate how risks are managed

Transparency is key. Regularly share how you are managing risks and impacts—through public reports, stakeholder engagement, or internal communications.

6. Provide for or cooperate in remediation

When harm does occur, be prepared to support or participate in remedy efforts. This could include direct remediation or engagement with grievance mechanisms.

3 strategic benefits of implementing due diligence

Implementing sustainability due diligence is more than protecting people and the environment, it is smart business strategy. Done right, it delivers long-term value by strengthening risk management, sharpening competitive advantage, and building investor trust in a rapidly evolving market landscape:

A life insurance policy

Sustainability due diligence uncovers deep-rooted environmental and social risks that traditional enterprise risk management often overlooks. These risks – like climate disruption, forced labour, or resource scarcity – tend to be systemic, long-term, and difficult (or impossible) to fix if discovered too late. Early identification and action act as a form of business life insurance, safeguarding long-term viability and resilience in a rapidly changing world

Market advantage

Today’s consumers, business partners, and regulators are increasingly prioritising environmental and social responsibility. Companies that embed sustainability into their due diligence processes position themselves to meet growing stakeholder expectations, win sustainability-conscious customers, and stand out in procurement and partnership decisions, gaining a real edge in an evolving marketplace.

Earn stakeholder trust

Robust sustainability due diligence demonstrates that a business is forward-thinking, well-governed, and ready to manage emerging risks. This builds investor confidence, enhances access to ESG-aligned financing, and can lead to better credit terms or inclusion in sustainability-focused investment portfolios. In an environment where capital increasingly follows ESG performance, credibility matters.

How to get started

For tailored support with due diligence preparation or implementation, reach out to our expert Anna Katharina Bierre at akb@nordicsustainability.com.

Implementing sustainability due diligence may seem like a complex undertaking – but chances are, you are not starting from scratch. Most companies already have some elements in place, whether it is supplier audits, risk assessments, codes of conduct, or sustainability reporting.

The key is to recognise these existing efforts and begin connecting the dots into a more structured and proactive due diligence process. Before jumping into the implementation phase, it is crucial to first lay a solid foundation by following a few key steps. These steps will help ensure that resources are allocated to the most urgent needs, ensuring a more manageable and efficient path toward full implementation.

The first step is to choose a benchmark – this could be the international guidelines (OECD and UNGP) or specific legislation like the Corporate Sustainability Due Diligence Directive (CSDDD) or the German Supply Chain Act. Once you have selected a benchmark, the next step is to map your existing efforts against the chosen benchmark’s requirements or guidance. This process will help you identify any gaps in your current practices that need to be addressed to meet these standards.

Following this, it is crucial to create a target implementation plan, and more importantly, prioritise the actions based on the severity of the gaps, available resources, and potential impact. Not all actions can or should be tackled at once, so it is important to assess where your company can make the most meaningful progress in the shortest amount of time. Focus on high-impact areas, such as the most critical risk exposures or those that directly affect key stakeholders (e.g., customers, investors, regulators), while also ensuring that you lay the foundation for addressing longer-term objectives.

With these foundational steps in place – choosing your benchmark, mapping your efforts, and creating a prioritised implementation plan – you will be well-prepared to move forward with implementing a structured, effective approach to sustainability due diligence.

Read more

References

1World Benchmarking Alliance: 2024 social benchmark

International guidelines

- OECD Guidelines for Multinational Enterprises on Responsible Business Conduct

- OECD Due Diligence Guidance for Responsible Business Conduct

- UN Guiding Principles on Business and Human Rights

Due diligence legislation

- CSDDD directive text and EU’s FAQ and

- EU Commission Omnibus I Proposal

- Forced Labour Regulation explainer

- Deforestation Regulation explainer

Due diligence in action

Join our upcoming webinar 'Preparing for CSDDD implementation' to see how leading companies Ørsted and Copenhagen Airports are working with Nordic Sustainability to get ahead on human rights due diligence.