The European Commission’s Omnibus Proposal marks a major shift in EU sustainability frameworks, aiming to streamline compliance and ease reporting demands. But what does this really mean for businesses in the new sustainability landscape?

In this webinar, Andreas Rasche (CBS), Mads Kampp Christiansen (DI), and Sven Beyersdorff (Nordic Sustainability), unpacked the core elements of the Omnibus Proposal, its broader implications for sustainability reporting, and what companies should consider in response.

What are the key changes in the Omnibus proposal?

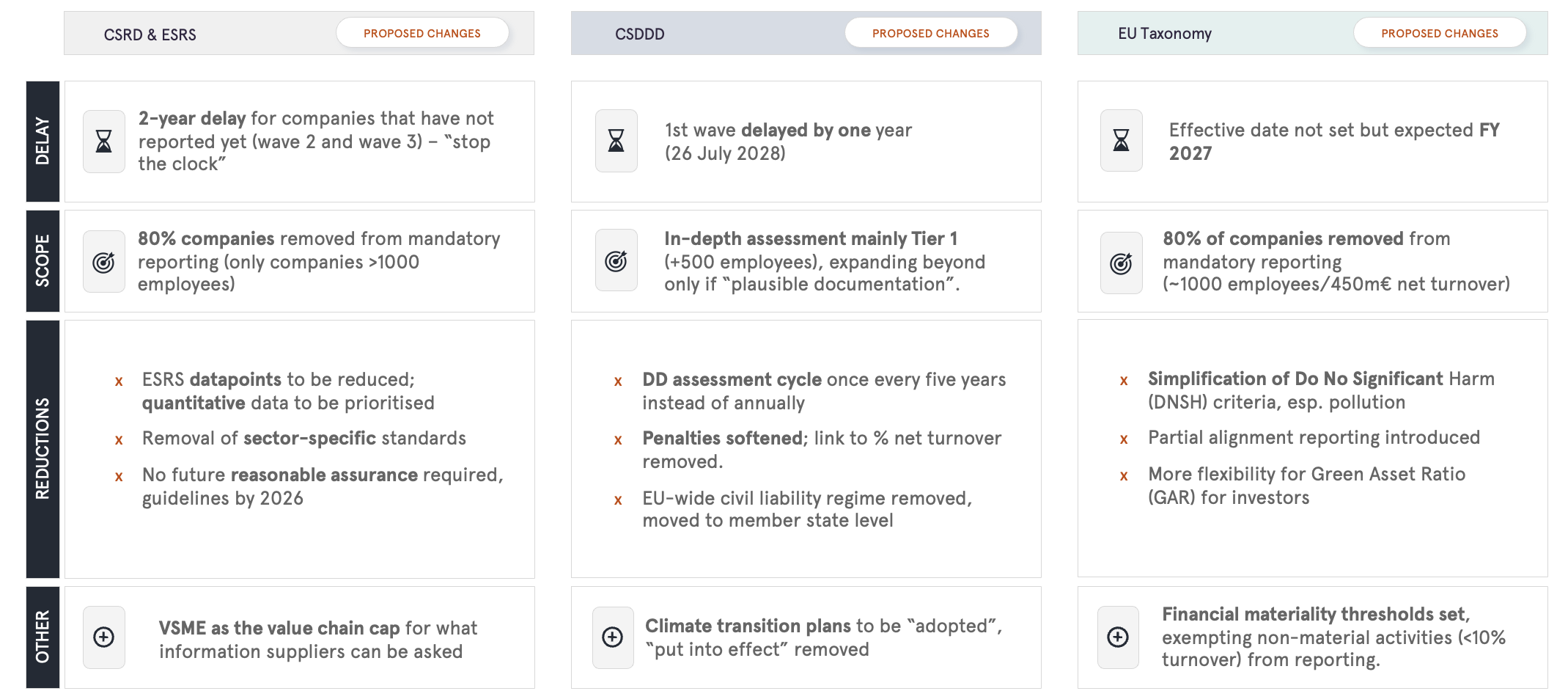

The EU Commission positions the Omnibus proposal as a move towards simplification, cost reduction, and enhanced competitiveness. The Omnibus introduces several modifications across CSRD, CSDDD, and the EU Taxonomy, including a significant reduction in the number of companies subject to mandatory sustainability reporting.

- Approximately 80% of companies are removed from the CSRD and EU Taxonomy scope, limiting reporting obligations to companies with 1,000+ employees that meet certain financial thresholds.

- The CSDDD sees notable changes, including a shift to assessments primarily at tier 1 suppliers, reduced assessment frequency to every five years instead of annually, and softened penalties.

- Datapoints are to be reduced across key sustainability legislations, aligning with the European Commission’s aim for a 25% reduction in administrative burden, and at least 35% for SMEs.

How do these changes impact EU sustainability frameworks?

CSRD & ESRS

Stop the clock: Companies in Wave 2 and Wave 3 see a two-year delay before mandatory reporting begins

Scope reduction: Only companies with 1,000+ employees remain under mandatory reporting.

Data simplifications: ESRS data points will be reduced, prioritizing quantitative over qualitative disclosures as well as removal of sector-specific ESRS reporting standards.

CSDDD

Delayed enforcement: First-wave implementation delayed to July 2028.

Narrower due diligence scope: In-depth supplier assessments required only at tier 1 (+500 employees) with further requirements applying only when “plausible documentation” exists.

Longer due diligence cycles: Once every five years instead of annually.

Softened penalties: The link to net turnover-based penalties is removed.

Climate transition plan obligations weakened: Climate transition plans must be “adopted,” but the requirement to “put into effect” has been removed.

EU Taxonomy

Implementation timeline unclear: Effective date not set but is expected for financial year of 2027.

Scope reduction: Reporting applies only to companies with 1,000+ employees or €450M+ in net turnover.

Simplification of Do No Significant Harm (DNSH) criteria: Primarily affecting pollution.

New financial materiality thresholds: Exempting non-material activities (<10% turnover) from reporting.

What should companies do now?

The Omnibus Simplification Package is an official legislative proposal that must undergo the full EU lawmaking process before adoption. The timeline remains uncertain, as EU legislative processes can take years. However, the Commission has urged fast-tracking the proposal to ensure early adoption.

Moving forward, companies should stay informed, assess potential risks in overpreparing and underpreparing, and act accordingly.

This leaves companies with some strategic options:

- Consider your reporting approach: Companies where CSRD is in national law are expected to continue reporting. Investors, banks, customers, and supply chains will still require sustainability data – engage to understand their evolving focus.

- Use what you have built: Double materiality assessments and risk identification are inherently valuable for companies, and many have spent a lot of time on these analyses. Use them to guide impact reduction, engage the organization, and strengthen resilience.

- Use sustainability for competitive advantage: Strategic integration is key to the EU’s competitive advantage goal. Embed sustainability in strategy, manage business risks, and address impacts like climate transition and circularity.