As the negotiations on the Omnibus I Simplification Package have come to a conclusion, many companies are left wondering what the road ahead looks like for sustainability reporting.

The simplifications leave around 90% of the companies previously in scope of the Corporate Sustainability Reporting Directive (CSRD) without legal obligations to report. The question that is top of mind for most: is it worth continuing to report voluntarily?

This article explores the potential benefits of sustainability reporting and what companies should consider if they want to develop their first report.

Lessons from our first years of CSRD implementation

Anyone following the recent developments on the EU’s sustainability reporting regulation will be familiar with the arguments that CSRD is overly burdensome and costly. The Omnibus Simplification Package I reflects a political effort to balance sustainability ambitions with competitiveness and administrative feasibility for European companies.

While establishing reporting practices and producing a CSRD-aligned report does no doubt require significant time and resources, many companies have also noted added value from reporting.

Learn from organisations already advancing with our CSRD and ESG work here.

Those who have overcome the initial hurdles, including navigating the complex requirements and onboarding new members to the reporting process, have come out stronger. Beyond a compliance exercise, the CSRD has helped kickstart or accelerate the sustainable transformation of many organisations.

The Bertelsmann Stiftung study reveals that sustainability reporting generates a broad range of benefits, from improved strategic decision-making to stronger stakeholder trust and enhanced operational performance.

In our work with both large and small companies across Europe, we consistently see the following benefits emerge from sustainability reporting processes:

Why voluntary sustainability reporting still matters

The demand for reliable ESG data will continue, regardless of where the final CSRD thresholds are set. Even if out of scope for CSRD, companies are likely to be faced with requests and requirements from key stakeholders. Hence, companies with strong reporting practices are better positioned to meet increasing expectations.

The 3 key stakeholder groups that will continue to demand credible ESG data are: business partners and customers, investors and financial stakeholders, and last but not least, internal stakeholders, namely, employees.

Large companies will require ESG data from their suppliers to meet CSRD and other reporting requirements. Many companies outside the scope of the CSRD already publish sustainability information on a voluntary basis. Some choose full alignment with the ESRS, while others adopt a lighter approach that reflects their size, resources, or position in the value chain. In both cases, voluntary reporting helps the companies structure and anticipate what customers and business partners are likely to ask for, reducing the risk of ad hoc requests or fragmented data. Standardised reporting can also help create a competitive advantage as customer expectations increase.

Banks and financial institutions increasingly integrate ESG risks into credit assessments for large corporates and SMEs. In practice, this means that a company’s ESG risks are also its bank’s ESG risks, and these risks do not disappear simply because a company falls outside the CSRD scope. As mentioned in our recent webinar on the updated ESRS, effective ESG integration and credible reporting continue to be critical to access to financing and the cost of capital.

Employees are another important stakeholder group, as studies show that sustainability is becoming a key factor for talent retention and attraction. Many expect clarity on their employer’s sustainability commitments and want to see tangible progress in achieving set targets. Transparent reporting can support this by providing a clear picture of where the organisation stands today and how it plans to move forward.

Design a reporting approach that aligns with your priorities, even if you are out of scope

Companies no longer in the scope of the CSRD can determine their approach to sustainability reporting by mapping clients and other stakeholders who will likely request sustainability information. This will help clarify reporting needs and expectations.

Companies with no legal obligations to report should define a reporting level that matches their resources and priorities. Beginning with a lighter format that focuses on the most material topics can help avoid unnecessary strain, while still meeting stakeholder expectations. Your organisation can gradually improve data quality and coverage over time. Voluntary approaches can range from full alignment with ESRS, selecting targeted ESRS disclosures or using the VSME as a reference framework.

5 practical tips to get begin your sustainability reporting

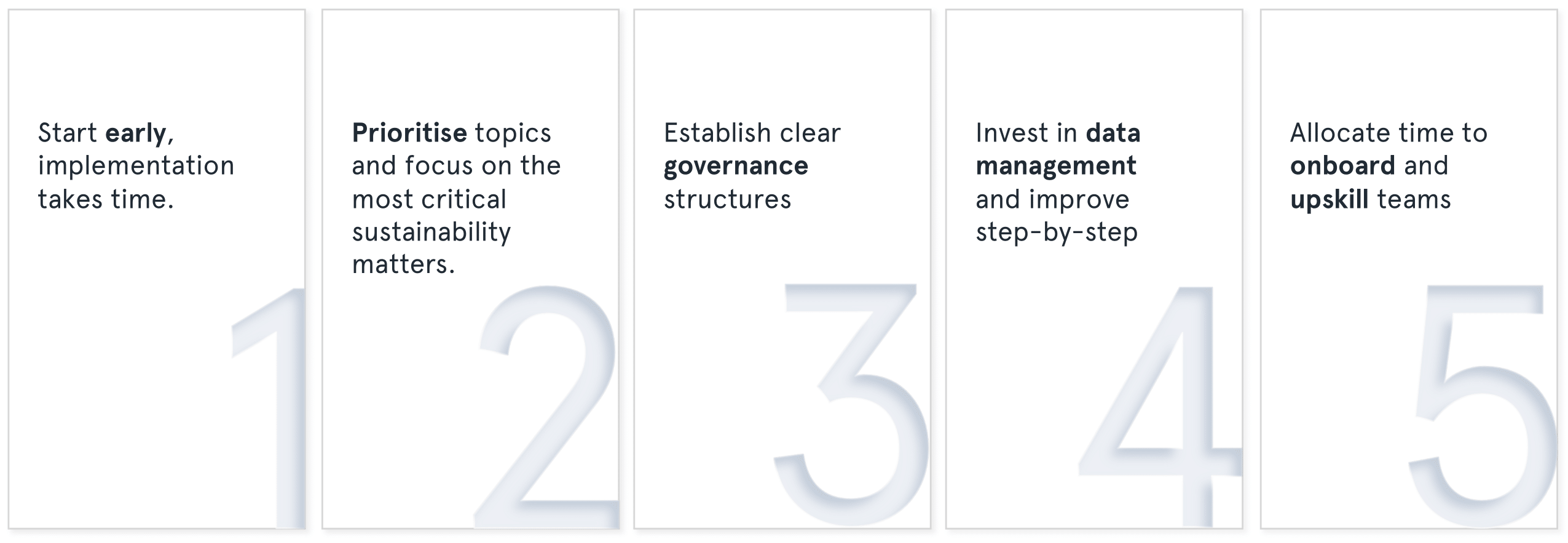

Companies that have decided to move forward with voluntary sustainability reporting can benefit from lessons learned from the first wave of CSRD reporting. Our experience shows that focusing on a few key considerations can maximise the positive impacts of sustainability reporting.

Developing the first sustainability report takes time. Start early to ensure sufficient time for setting up strong reporting practices from the beginning. It is also good to note that it is often easier to establish the structures and systems you need for reporting in a smaller organisation; don’t wait for your company to grow.

Developing the first sustainability report takes time. Start early to ensure sufficient time for setting up strong reporting practices from the beginning. It is also good to note that it is often easier to establish the structures and systems you need for reporting in a smaller organisation; don’t wait for your company to grow.

Focus on the most critical sustainability matters. Consider what your clients and other stakeholders will expect, and avoid overburdening your teams by striving to cover everything in the first reporting cycle.

Focus on the most critical sustainability matters. Consider what your clients and other stakeholders will expect, and avoid overburdening your teams by striving to cover everything in the first reporting cycle.

Clear roles and responsibilities help ensure accountability, improve efficiency and strengthen collaboration across the organisation.

Clear roles and responsibilities help ensure accountability, improve efficiency and strengthen collaboration across the organisation.

Build a solid foundation through transparent accounting policies. Identify your key data sources and, where possible, consolidate them in one system. No company begins with perfect data, so start with what you have, focus on the most relevant topics and outline a clear plan for improvement. Strengthening data management in this way can lead to data insights that result in concrete efficiency measures.

Build a solid foundation through transparent accounting policies. Identify your key data sources and, where possible, consolidate them in one system. No company begins with perfect data, so start with what you have, focus on the most relevant topics and outline a clear plan for improvement. Strengthening data management in this way can lead to data insights that result in concrete efficiency measures.

The sustainability department alone cannot produce a comprehensive sustainability statement. Teams from across the organisation need to contribute the necessary data and insights. Early clarification of reporting requirements and responsibilities improves efficiency and reduces stress. Building a broader understanding of sustainability reporting and ESG data also supports the longer-term integration of sustainability into core operations.

The sustainability department alone cannot produce a comprehensive sustainability statement. Teams from across the organisation need to contribute the necessary data and insights. Early clarification of reporting requirements and responsibilities improves efficiency and reduces stress. Building a broader understanding of sustainability reporting and ESG data also supports the longer-term integration of sustainability into core operations.

Whether driven by regulation, client expectations or internal ambitions, companies benefit from building the structures that allow them to understand their impacts, risks and opportunities and act on them. For many organisations, these capabilities are becoming part of what it means to run a resilient and forward-looking business.

Want to get started or get further?

Nordic Sustainability has successfully supported leading companies across Europe build robust reporting structures that drive compliance, strategic decision-making, and long-term resilience. Reach out to our Managing Partner, Anniina Kristinsson, at akr@nordicsustainability.com to get started.

Read more

- Study by Andreas Rasche et al., “Scenarios for CSRD Scope Amendments – Advancing Reporting Scope while Reducing Further Burden”

- The European Commission on the Omnibus Package

- The Bertelsmann Stiftung study, “More Than Reporting: How Sustainability Reporting Creates Value for Companies”

- Our latest review of the Omnibus Proposal after the Parliament vote

- A webinar on creating an ESRS-aligned sustainability strategy

- A step-by-step guide on how to implement a Double Materiality Assessment

The latest in European regulatory news

We invited Ørsted and Nykredit to a live discussion to learn how the new legislative changes impact their work.