The EU’s new Corporate Sustainability Reporting Directive (CSRD), with its accompanying technical framework, the European Sustainability Reporting Standards (ESRS), is taking the corporate sustainability landscape by storm. Over 50,000 companies are in the scope of the overarching directive.

The double materiality assessment (DMA) is the cornerstone of the ESRS. The outcome of a DMA is a list of material (read: important) sustainability-related impacts, risks, and opportunities (IROs). These IROs then determine the specific disclosures and data points the company must include in the final sustainability report.

While conducting a DMA is a regulatory requirement under the ESRS, the outcomes of a DMA can also be leveraged for much more – for instance, to build the foundation of an overarching sustainability strategy. A robust, effective, and ESRS-compliant DMA process can seem like an overwhelming exercise at first glance. In this guide, we walk you through the key steps of a successful DMA and share our reflections on how to overcome common challenges and misconceptions that companies face when conducting the DMA process.

Double what?

Let’s start with a reminder of the purpose of the double materiality assessment, which, as already briefly stated in the introduction, is to identify and assess the reporting company’s sustainability-related IROs. The IROs that are deemed most important (i.e. ‘material’ to the company) define the information needing to be disclosed in the final sustainability report.

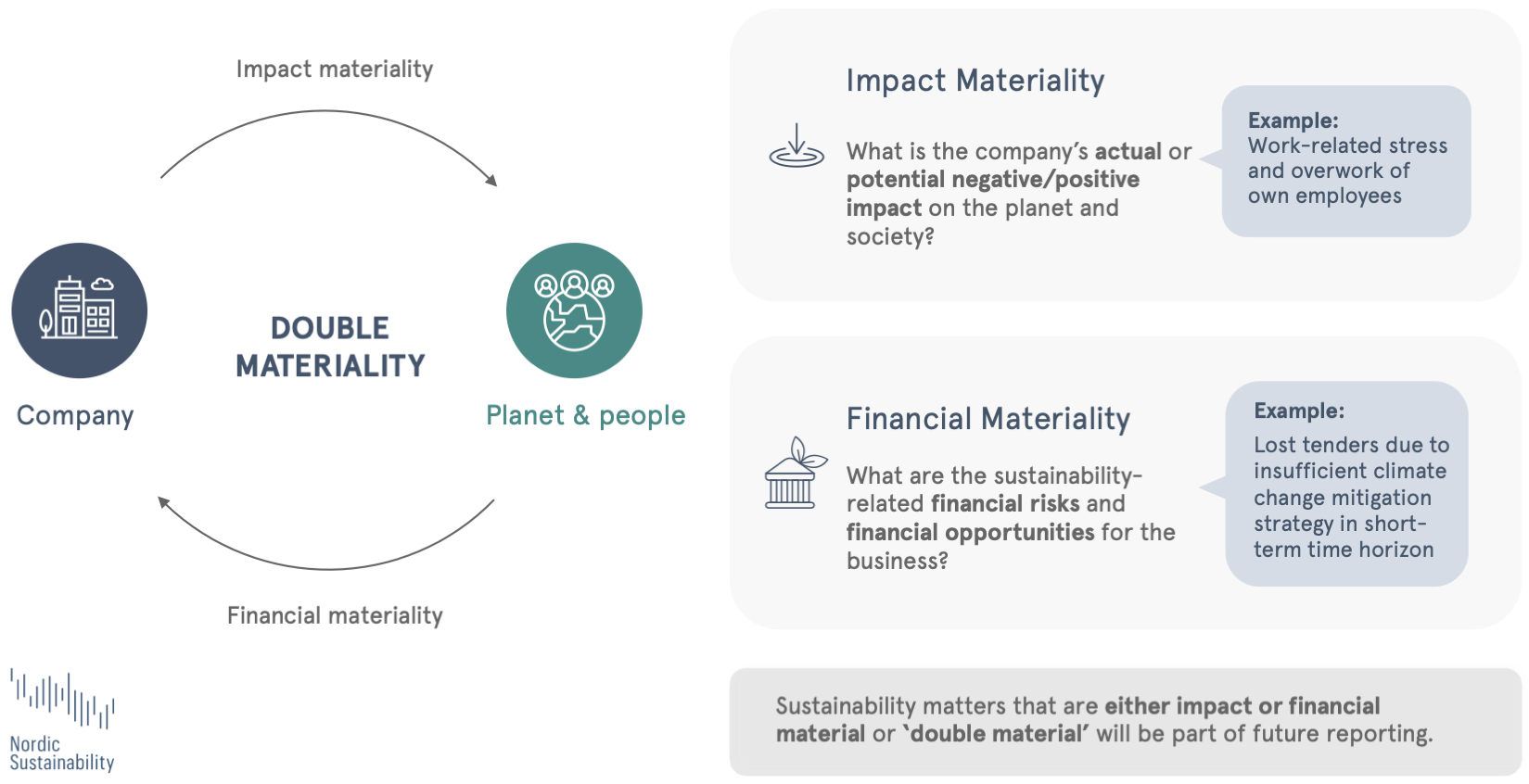

Now, we move on to the ‘double’ angle, which covers both the impact and the financial materiality lens. Impact materiality looks at how the reporting company’s activities affect people, the environment, and society – for example, how the company contributes to climate change or social inequality.

On the other hand, financial materiality examines how sustainability issues impact the company’s financial health. Through the financial materiality lens, one might assess how, for instance, climate risks or regulatory changes affect the company’s profits and long-term viability.

In short, companies must assess and report on both their impact on the world and the potential impact of sustainability issues on the company.

Why (fact-based) double materiality is an extra important exercise

Conducting a robust DMA is an important exercise for two main reasons:

1. The DMA is a regulatory requirement

As clearly stated in the ESRS 1 (General Standard, Chapter 3), companies in the scope of the CSRD and ESRS must report on sustainability matters based on the double materiality principle.

Two fundamental shifts that the CSRD and ESRS introduce are a) establishing the DMA as a mandatory process for companies in the scope of the regulation and b) encouraging fact-based materiality over perception-based materiality – meaning that the assessment should not be based on subjective stakeholder opinions (the “old” way of doing it), but on actual and potential impacts, risks, and opportunities backed up by evidence or justified assumptions.

In the context of the ESRS, the results of the DMA will also determine what data points the report must include. Therefore, the DMA will help guide reporting companies on where to focus their ESG data collection efforts.

2. Material IROs can be used to inform overarching strategies and action

The outcome of a DMA will give you an overview of your most important sustainability topics. Ideally, you would want these topics to inform your sustainability strategy. Why is that? When examined, addressed, and managed effectively, businesses can transform their material sustainability impacts into drivers of commercial success and ensure long-term resilience. Ultimately, treating material issues as strategic priorities ensures that sustainability isn’t just an isolated initiative but a key factor in driving profitability, improving risk management, and creating value across the entire organisation.

Key steps of a successful DMA

Now, how do you conduct a robust ESRS-based DMA? As previously mentioned, the ESRS outlines key methodological concepts for conducting a DMA but leaves several areas open-ended. That is precisely why we will guide you through the most crucial steps, helping to clarify any uncertainties along the way.

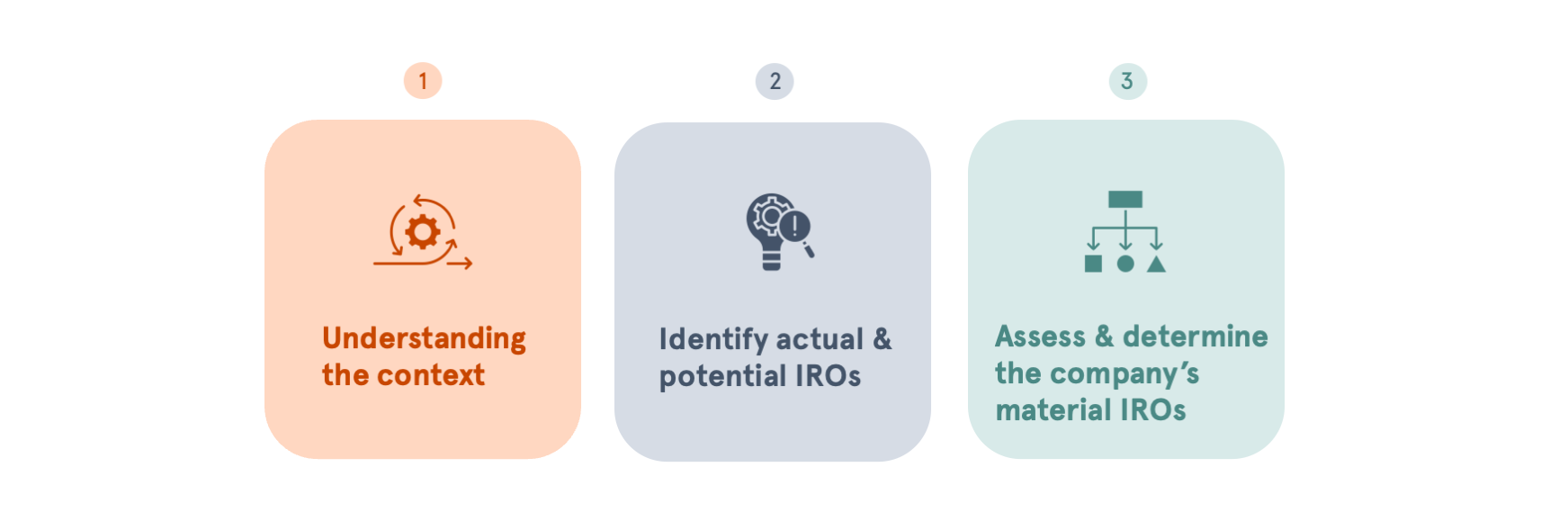

1. Understanding the context

Firstly, the reporting company needs to develop an aligned overview of its value chain, which consists of its key activities and business relationships, the context in which these take place, and an understanding of its key affected stakeholders. This information serves as important input to the identification of relevant IROs later in the process.

Suggested sub-steps:

- Gather information on the company’s a) key activities, products and services, and geographic locations, b) business plan and strategy, c) business relationships and their nature, and d) other contextual information, such as analyses of the company’s relevant regulatory landscape, published media reports, customer reviews, sector-specific benchmarks, and relevant scientific articles.

- Based on this information, map out the value chain and validate the outcome with key internal stakeholders to minimise blind spots (to the extent possible).

- Gather information on the company’s existing stakeholder engagement initiatives (e.g. via communication channels, sales and procurement teams, investor relations, and business management), including the vital sustainability topics addressed through these initiatives.

- Based on this information and the value chain overview, map out the potentially affected stakeholders across the different value chain activities. Examples of affected stakeholders include i.e. employees, local communities, suppliers, future generations, and more.

2. Identification of the actual and potential IROs

Secondly, the reporting company must identify its actual and potential IROs relating to ESG matters along the entire value chain. The outcome of such a process will be a long list of IROs, which will then be assessed in step 3.

Suggested sub-steps:

- A good initial approach is to review the sustainability matters listed in ESRS 1 (General Requirements) AR16. While the ESRS sector-specific Standards are still in development, any sector—and entity-specific matters not covered by this list are to be considered and, if relevant, added. Internationally recognised frameworks such as the GRI Sector Standards can serve as a good starting point for identifying sector-specific matters.

- Identify and start writing out a list of relevant IROs for all the sustainability matters that were deemed in scope in the previous sub-step. If you are in doubt whether an IRO will be relevant, we suggest including it. The next step (3) will help you determine its materiality further.

- You should now have a long list of all identified IROs. For each IRO, outline a) which sustainability matter(s) from the AR16 list it links to, and b) whether it relates to the company’s own operations or a value chain activity (and if so, which).

- Validate this list of identified IROs with key internal stakeholders and external stakeholders (particularly with identified affected stakeholders or their representatives) to ensure completeness.

3. Assessment and determination of material IROs

Lastly, the list of identified IROs will undergo an in-depth assessment from both the impact and financial angle to determine their materiality to the reporting company. We recommend reserving most of the time for this step, as it has proven to be time-consuming. The outcome of this step forms the basis for determining material information based on the ESRS topical Disclosure Requirements.

Suggested sub-steps:

- Review the ESRS 1 (General Requirements) and ESRS 2 (General Disclosures) to understand what methodological concepts must be in place for the assessment. Most importantly, the company must establish a robust assessment methodology, including, for example, well-defined assessment criteria and appropriate qualitative or quantitative thresholds to determine the impact and financial materiality of the identified IROs and their related disclosures.

- Develop the assessment methodology according to the concepts outlined in the ESRS. For the financial materiality methodology, you might derive inspiration from existing enterprise risk management processes (if applicable). Ensure that the methodology is documented systematically and extensively, as your auditors will want to look particularly at this process step.

- Apply the assessment methodology developed in the previous step to your list of identified IROs established in phase 2. Also, ensure that assessment rationales, sources, and assumptions are thoroughly documented (e.g., for the IROs related to the broader value chain).

- Validate the assessment with key internal stakeholders and external stakeholders. We recommend involving affected stakeholders or their representatives to ensure completeness of the impact materiality picture. As for the financial materiality side, we recommend engaging with the company’s financial and risk management business functions, as well as with investors and other financial counterparties (such as banks).

- Consolidate the results to obtain the final list of material IROs. An IRO can be material either from one angle (impact/financial) or both. Making the distinction is essential for determining which Disclosure Requirements and underlying data points will be triggered.

Et voilà. You should now have a well-informed and well-documented understanding of your material ESG impacts, risks, and opportunities.

3 challenges of double materiality – and how to tackle them

Having guided dozens of companies through ESRS-based double materiality assessments, we’ve observed recurring pain points centered around three key areas: ESRS knowledge, internal time and resource constraints, and data collection challenges.

While the ESRS provides mandatory principles and methodological concepts for companies undertaking a DMA, it leaves certain areas open to interpretation. This flexibility allows companies to tailor the process to their needs but can also lead to confusion and inconsistent application.

While the ESRS provides mandatory principles and methodological concepts for companies undertaking a DMA, it leaves certain areas open to interpretation. This flexibility allows companies to tailor the process to their needs but can also lead to confusion and inconsistent application.

To navigate this, it is crucial that companies thoroughly understand the ESRS requirements and the intricacies of the DMA to avoid overseeing critical details that might jeopardise regulatory compliance. However, given the legal complexity and dense language of the ESRS, this can be a daunting task. Fortunately, EFRAG — the body responsible for drafting the ESRS — has released more accessible guidance to support companies with the implementation of the new regulation. Many businesses also opt to work with external advisors with deep expertise in this field to ensure they stay on track.

The ESRS encompasses a broad range of ESG topics and requires extensive cross-departmental collaboration to reach compliance. The requirements mark a shift away from traditional sustainability efforts, which often meant working in silos. Sustainability can no longer be a niche concern but must be a company-wide effort involving multiple internal stakeholders.

The reporting requirements under the ESRS are also rigorous and time-consuming, significantly increasing the internal workload. Due to this, many companies focus on conducting a thorough data gap assessment after completing their DMA. The results of this assessment can be used to justify to executives the need for additional resources to meet ESRS reporting demands successfully.

Even for companies with mature sustainability programs, achieving full transparency across the value chain remains a significant challenge — precisely one that the ESRS aims to address. Companies are required to assess their entire value chain in the DMA, which can be difficult when critical information is missing, especially beyond tier-2 suppliers or regarding end-users.

However, perfection is not the goal in the initial reporting years. Where primary data is lacking, companies are encouraged to use secondary sources. For example, if insights into upstream suppliers are unavailable, businesses can rely on industry-specific research and regional studies to make informed assumptions about potential impacts in their value chain. This pragmatic approach allows companies to move forward with reasonable confidence while continuously improving data accuracy.

Debunking 3 common misconceptions about double materiality

A common misconception is that materiality assessments focus on evaluating performance in specific ESG areas. However, materiality isn’t about how well a company performs on sustainability—it’s about identifying which issues are of the highest significance from either an impact or financial perspective.

Material topics can include areas where a company is already excelling and where improvement is needed. A DMA highlights significant IROs, enabling companies to focus resources where they matter most, regardless of whether performance is already strong or needs development.

Another related misconception is that identifying a topic as material implies the company fails to address it adequately – this is not necessarily the case. A material topic could be one where a company is already leading the way, but because of its importance, it remains a key area of focus.

It is important to remember that identifying something as material simply means the topic is significant for the business’s long-term success or its stakeholders. A well-managed material topic can provide competitive advantages and highlight strengths to external parties, such as investors or consumers. Conversely, if a material topic is not sufficiently addressed, it highlights where action may be required. Either way, materiality helps guide decision-making and future strategic focus.

There is often a belief that identifying more material topics reflects a more comprehensive or serious approach to the DMA. However, materiality is about prioritisation – not volume. Focusing on too many issues can dilute attention and resources, making it challenging to manage the areas that truly matter most effectively.

A DMA aims to pinpoint the key issues that have the most significant impact on the company and its stakeholders. Trying to address every potential issue can lead to inefficiency and strategic misalignment. Instead, a well-executed DMA should help companies concentrate on a manageable number of truly material topics, allowing for more focused, impactful actions that drive sustainability performance and business success.

Requirements of the CSRD have the potential to be a catalyst for genuine impact and business model change

The CSRD and ESRS are transformative in their requirements for sustainability reporting and links to business models and strategy. The next steps for many companies will be to develop strategies informed by the double materiality assessment, and this is where the real impact will start.

Our CSRD implementation guide provides further insights into the steps companies must take after completing their DMA process.

If you have more questions about CSRD and double materiality assessments, you’re welcome to reach out to our Regulation & Policy Team Lead:

Read more

- CSRD directive and FAQ

CSRD implementation guide

Learn how to navigate the CSRD reporting process effectively