A look into how CSRD is being rolled out across the financial sector.

CSRD is the most ambitious EU-mandated sustainability regulation yet and it will have large implications for the financial sector. Aside from having to comply themselves, by prescribing increased transparency of a company’s sustainability impact, CSRD will provide better information for financial stakeholders to base their investment/financing decisions on. Below is a summary of what the requirements of CSRD are:

The impending challenge to financial institutions

Financial institutions (FIs) are fundamentally different to the real economy as they interact with multiple industries through their financing and investing, exerting only indirect control over their clients’ activities. It is standard practice for FIs to diversify investments by financing a wide set of sectors and asset classes, creating a complex value chain.

EFRAG are yet to release financial sector-specific guidance, and indications suggest further guidance will not be received within the next 1-2 years. As of now, there are two main approaches an FI can take:

-

Conduct the Double Materiality Assessment (DMA) on a sector or asset class basis – comprehensive but time-consuming.

-

Perform high-level groupings of activities and extrapolate using external proxy data – more manageable but fewer actionable results.

This lack of guidance from EFRAG leaves the sector in a tricky position as each has the freedom to choose their own approach, resulting in a wide range of potentially incomparable outputs. This could then result in the clients of these FIs facing a host of different data requests from their various investors and lenders.

The financial sector plays a pivotal role in the transition, not just through their provision of capital but also in the influence and steering they have over the real economy. Using the CSRD as a strategic tool alongside ensuring reporting compliance is essential in allowing FIs to support the Green Transition.

Our survey’s purpose

We conducted a survey with 14 financial sector firms across Nordic (67%), European (27% wider EU) and outside of the EU(6%), aiming to obtain deeper intra-sector insight on how respondents are feeling about the regulation and what steps are being taken internally to address the challenges.

The objective of this survey was to identify the most pressing issues faced by FIs and better understand how these can be addressed through our work as consultants. The more openly we can share and discuss learnings, the easier this process will become for everyone in the long run.

Our three key findings

1. Strong focus on reporting

Survey findings

While our findings show that FIs have a reporting-focused outlook on CSRD, they also highlight a lack of internal discussions beyond the necessary year 1 report. 84% of respondents are discussing CSRD at the Executive/C-suite level (Figure 2). While this is promising, these discussions are mainly focused on internal resource allocation for reporting and functional anchoring rather than how CSRD will impact the FI going forward.

No respondents report discussing business-model links or the impact CSRD will have on financing and investment strategies with the C-suite and 40% believed CSRD will have no immediate impact on these practices. From the remaining percertage 10% planned on doing post-assessment alignment and 50% was unsure. This is despite respondents placing the impact of results on financing and business model as the top two challenges. This contradiction suggests a lack of acceptance or ability to make changes to financing decisions, despite recognising that is what CSRD requires.

Implications for CSRD success

Having a primarily reporting-focused attitude towards CSRD conflicts with the spirit of the regulation. CSRD’s intention is not solely for companies to report more information, but to understand and then try to change their impacts. One of the mechanisms for this is the requirement as part of the regulation to identify business model links. For Financial Institutions, this is reviewing financing policies, as that is where 90% of their impacts occur. FIs should leverage the output of CSRD as a catalyst for change, and ask the question, what effect is our financing really having? This will lead to further de-risking of assets and new potential financial products that create a genuine positive impact.

2. Priority on the short term

Survey findings

Just under 40% of surveyed companies have 3+ FTEs dedicated to CSRD, and these are split across functions (Figure 3). However, only 7% plan on increasing the number of FTEs on CSRD after year 1, which is surprising. This assumes that the majority of the work is done after initial reporting whereas the real action comes later, once business practices must be changed. We also compared CSRD progress against the number of respondents in year 1 vs 2 of reporting waves (Figure 4). The majority of first-wave companies have conducted their double materiality and data gap assessments, being broadly on track. Among second-wave respondents, however, roughly half are still unsure about their position, while the remainder have only begun preparations at this point.

Implications for CSRD success

Having a primarily reporting-focused attitude towards CSRD conflicts with the spirit of the regulation. CSRD’s intention is not solely for companies to report more information, but to understand and then try to change their impacts. One of the mechanisms for this is the requirement as part of the regulation to identify business model links. For Financial Institutions, this is reviewing financing policies, as that is where 90% of their impacts occur. FIs should leverage the output of CSRD as a catalyst for change, and ask the question, what effect is our financing really having? This will lead to further de-risking of assets and new potential financial products that create a genuine positive impact.

3. Sector-wide challenge to meet data requirement

Survey findings

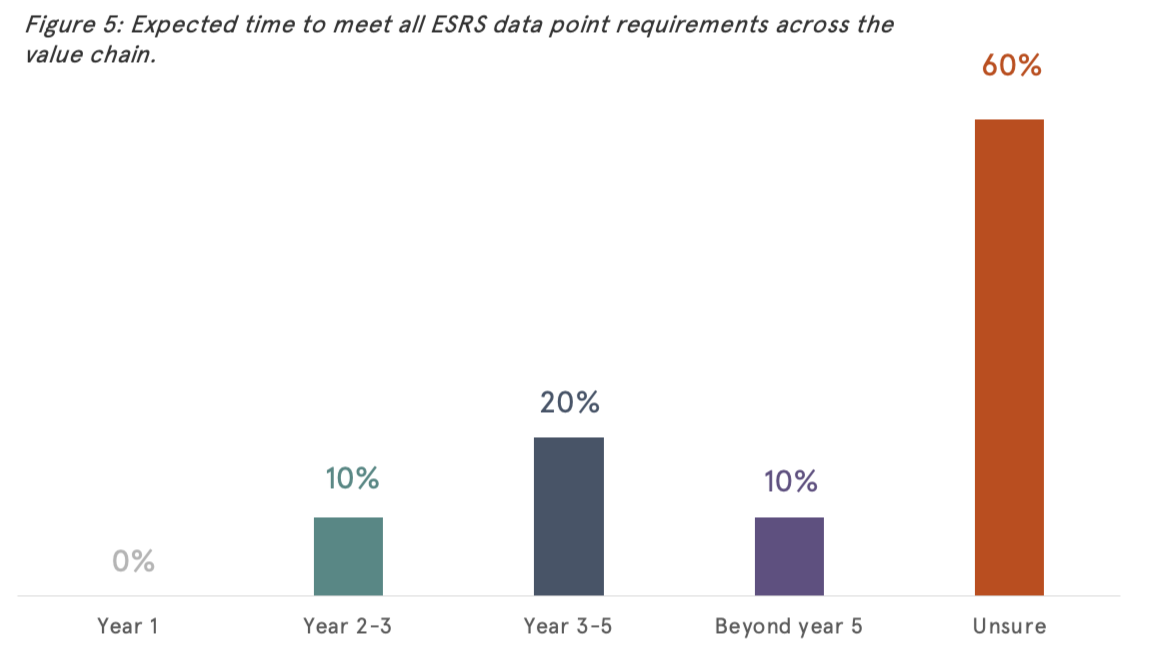

In ranking the relative severity of different CSRD-related challenges, the need to collect data from holding companies and investees post-DMA is the second most severe challenge. 10% of respondents feel that they will meet data requirements by years 2-3, while most are unsure of when or if they will ever meet the full set (Figure 6). As mentioned, the data requirements for CSRD reporting are extensive and, due to the breadth of holdings and sectors covered, data collection is an especially difficult process for FIs. Despite knowing this will be a challenge, no respondents currently have plans in place to engage with clients over CSRD in the short term.

Implications for CSRD success

Unsurprisingly, the data collection aspect of CSRD is by far the most challenging, which is the situation for most companies. Whilst reaching out to every client/investee company is impossible for now, FIs can use CRSD to their advantage. Over the coming years, there will be a wave of incoming data from companies in the scope of CSRD available for FIs to process. Getting ahead of the curve by becoming better equipped to handle the data and extract relevant conclusions presents a huge competitive advantage for FIs. Successful implementation programmes will include early discussions about what to prioritise, how to build the data capabilities, and then begin collecting and analysing.

Our findings from Nordic Sustainability

CSRD aims to increase transparency of companies’ relationships with the systems around them to enhance positive and reduce negative impacts. For the financial sector, this lies primarily in their financing and investment activities. The number of participants not anticipating any changes in these strategies is surprising.

We, at Nordic Sustainability, see CSRD as a transformational tool that should be treated as such – if it is to be implemented correctly. It is a challenge for all companies and the initial rounds of reporting are likely to be the most challenging. Future years will become easier as more companies report using CSRD, making value chain data more accessible and simplified.

From the results of the survey and our experience in the sector, it seems there is consensus over the biggest challenges of CSDR, namely impact on financing, data collection etc. However, there is still work left to do in the financial sector to overcome these challenges. It is encouraging to see evidence of strides being taken in the right direction for example the cross-collaboration of teams working together on CSRD, involving skills and commitment from across the organisation. Financial institutions need to now start asking the tougher questions such as ‘how does this effect our financing strategies?’ and ‘how do we integrate this into business as usual?’.

Here are our three top tips from our experience with CSRD:

- Use the CSRD as the strategic tool it was designed for: CSRD is a trojan horse of regulation. It is disguised as reporting but essentially forces companies to consider sustainability as importantly as they do risk. Not accepting this and just treating it as a reporting burden will likely leave some organisations at a disadvantage.

- De-centralise the process: Responsibility needs to be anchored, but this is not an undertaking for one team. Ensure ownership throughout the business and across teams to embed CSRD throughout the organisation.

- Don’t underestimate the culture shift: Implementing an inside-out approach is a new method of thinking. Risk to the businesses is only half the picture – integrating this with impact on the planet requires a mental shift, patience, and a decisive effort.