On December 4th, Nordic Sustainability hosted a session on the path ahead for in-house sustainability practitioners. The panel included Troels Børrild, Head of Strategy at Nordic Sustainability, Franziska Matthaei, Associate Strategy Team Lead, and Sven Beyersdorff, Managing Partner and Co-Founder of Nordic Sustainability.

A changing landscape for sustainability

Sven opened the session with an overview of how 2025 has been marked by regulatory uncertainty, political backlash against sustainability agendas and diverging trajectories between major regions.

Despite this volatility, Sven pointed to encouraging signs among leading companies. Enterprise risk functions are beginning to incorporate longer time horizons and climate-related risks more systematically, strengthening the link between sustainability and strategic decision-making. Many organisations are continuing to advance climate transition plans, assess the costs and levers of decarbonisation and integrate these considerations into business planning. He also highlighted the growing focus on supplier engagement and procurement reforms, which are gradually reshaping expectations across value chains.

Looking ahead, Sven argued that the increased emphasis on value creation may bring sustainability closer to core business decisions than before.

5 focus areas for in-house sustainability teams

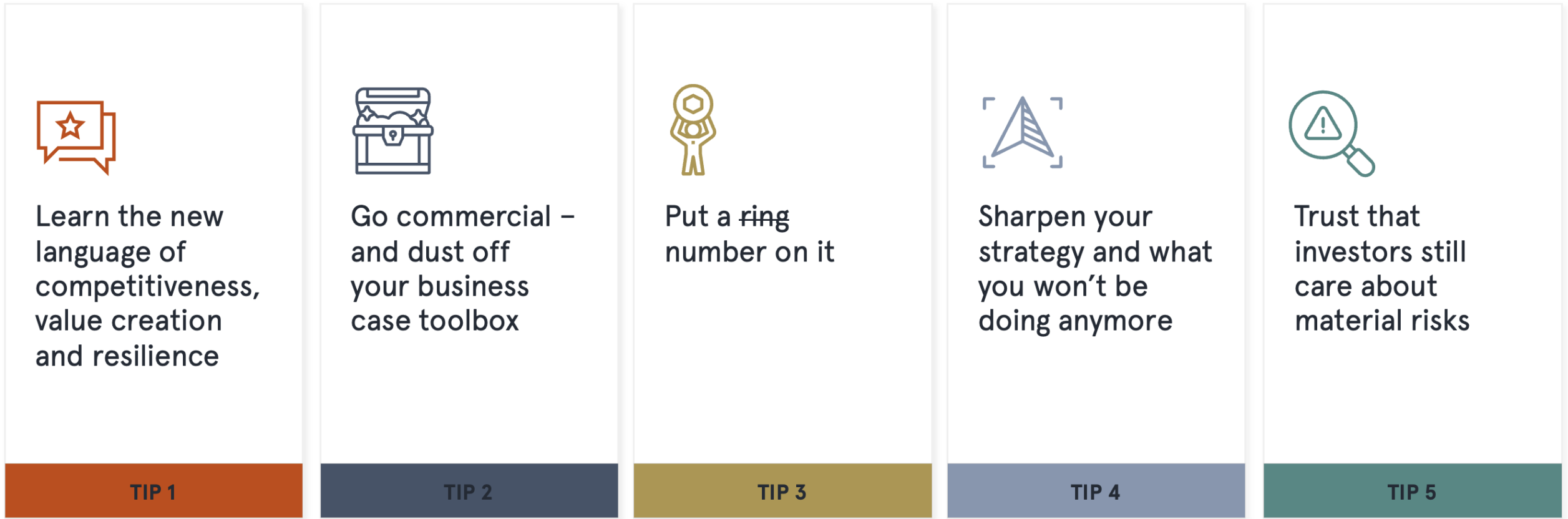

Drawing on a recent roundtable with senior practitioners and investors, Troels and Franziska outlined five areas where in-house teams can strengthen buy-in and practical impact.

Read our recent article, comprehensively elaborating on these tips here.

- Strengthen fluency in competitiveness, value creation, and business resilience

To influence decisions, sustainability teams need to use the financial language that guides resource allocation.

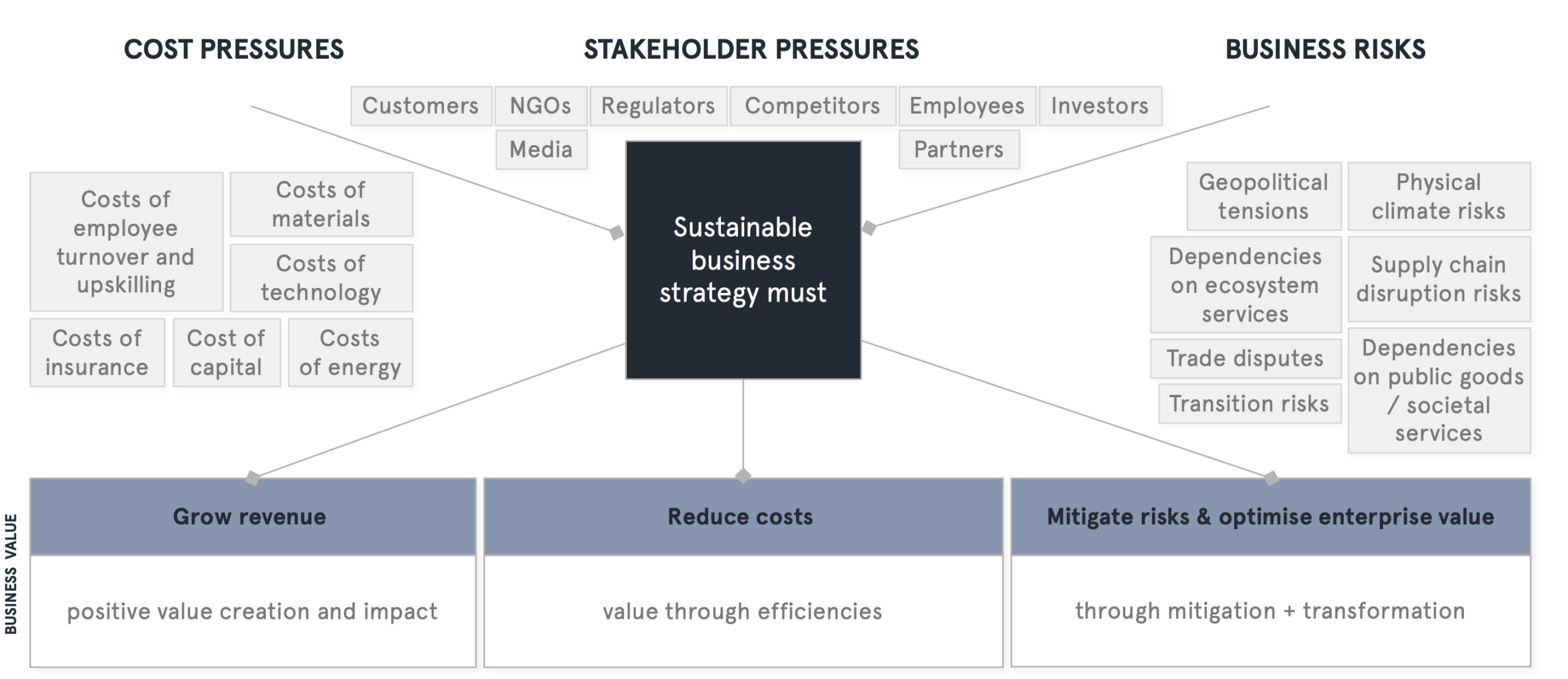

For this, Troels introduced the value-creation framework from the Principles for Responsible Investment (PRI). The framework brings together a wide set of sustainability levers and shows how they can influence revenue, cost, risk, or enterprise value. Examples include improving customer value propositions, lowering production costs, and reducing supply chain exposure.

The framework is not perfect. It understates the risks of inaction and does not fully account for upfront CAPEX needs. For in-house sustainability teams, this means: create your own version, tailored to your industry, and use it to anchor internal discussions in well-understood commercial terms.

- Rebuild the business case using metrics that already matter internally

With parts of the regulatory agenda delayed, sustainability work must be justified through the commercial relevance it creates. Teams should not reinvent the wheel, but rather use the business metrics already familiar within the company.

Treat sustainability initiatives like any other strategic investment case. Quantify assumptions, assess CAPEX needs, and make environmental impact part of the evaluation. This builds credibility with decision-makers and keeps sustainability aligned with the company’s core financial logic.

- Make long-term risks tangible with numbers

Short-term ROI expectations often dominate internal priorities. To counter this, Franziska encouraged teams to quantify the cost of inaction in practical terms.

This includes modelling:

- Exposure to extreme weather events across production assets

- The financial effect of supply chain disruptions

- Dependence on high-risk sourcing regions

- Alternative sourcing scenarios and their cost implications

These numbers do not need to be perfect. Their purpose is to make long-term resilience visible in the same decision space as short-term performance.

- Sharpen priorities and align with the company’s current strategic focus

Many sustainability teams are reconsidering their priorities. The key question is which contribution matters most to the C-suite right now: revenue growth, cost reduction, or risk mitigation.

The recommendation is not to abandon other objectives, but to adjust how they are communicated and sequenced. Sustainable business strategies must deliver value now and over time.

While long-term targets remain important, 2026 will require showing near-term relevance and focusing on the areas where sustainability most clearly supports the business. In order to transform and unlock the value of sustainability, your operating model is still key to successful strategy implementation and getting things done.

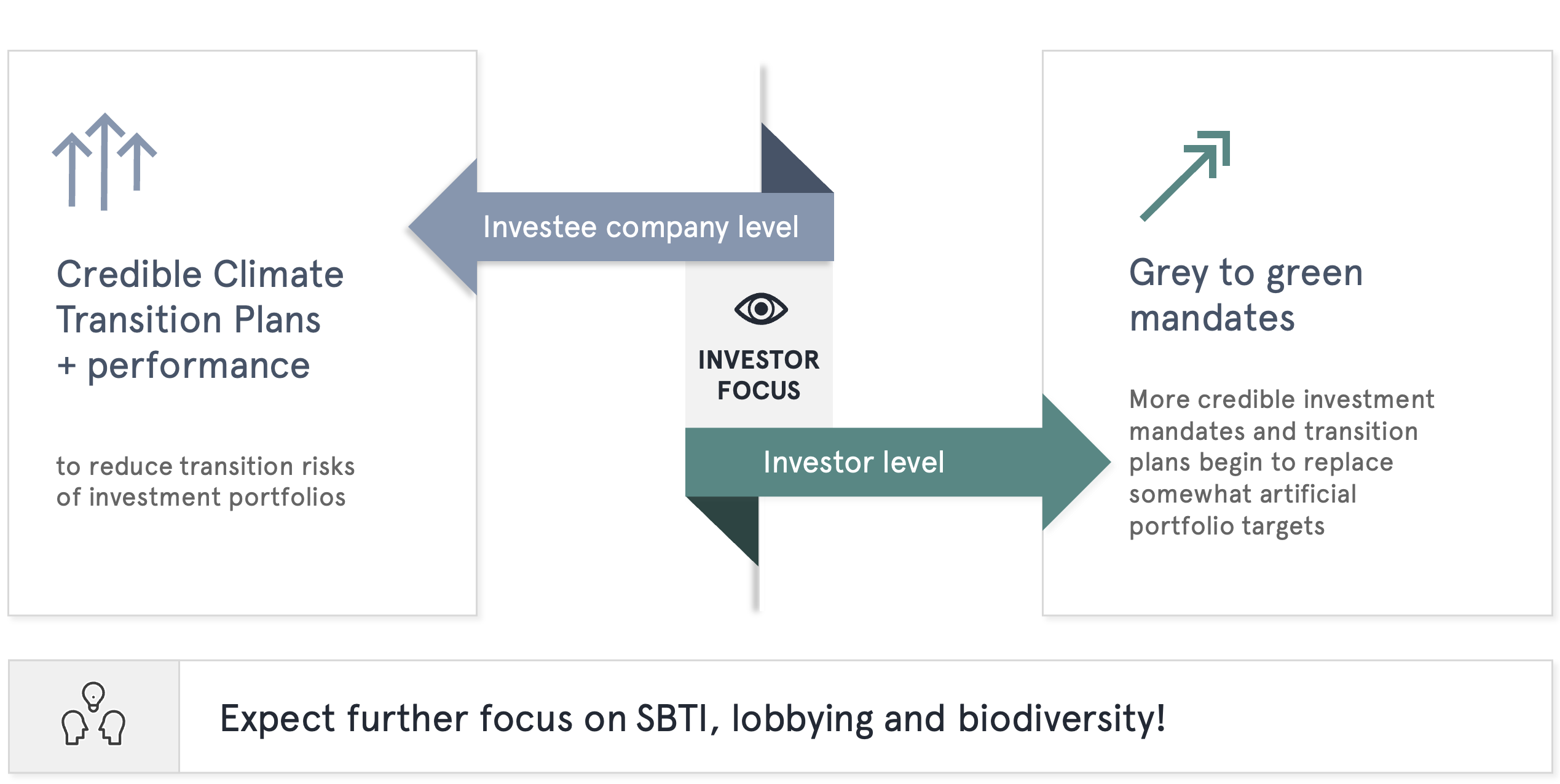

- Use investor expectations as a source of internal momentum

While rhetoric may have shifted in some regions, investors still expect companies to manage material sustainability risks. There is continued demand for credible transition plans backed by CAPEX pathways, stronger portfolio targets, and more attention to biodiversity, lobbying transparency, and supply chain resilience.

These expectations give sustainability teams a clear internal reference point. There is a need for progress and to provide legitimacy when discussing investment needs and prioritisation choices.

Ready to embark on your new way forward?

Many companies struggle to connect sustainability ambitions with commercial reality. That’s where we come in.

Our Sustainability Strategy Assessment is a focused 2.5-hour workshop designed specifically for sustainability and commercial functions. Together, we’ll:

✓ Identify the gaps between your current strategy and emerging transition risks

✓ Uncover hidden opportunities where sustainability can drive revenue growth

✓ Align your teams on a streamlined agenda, so you stop debating and start executing

✓ Future-proof your business model before capital or insurance force your hand

The outcome? Actionable recommendations on where to focus your sustainability budget for maximum impact, and a stronger case for change that resonates with commercial leadership.

Request our workshop

Our 2.5-hour workshop helps sustainability and commercial leaders identify gaps, align priorities, and turn sustainability into a competitive advantage before transition risks force reactive changes.