Over 50,000 European companies are facing a sweeping regulatory shift: the Corporate Sustainability Reporting Directive (CSRD). The directive mandates companies to conduct detailed, evidence-based assessments, manage comprehensive data across the value chain, and engage actively with key stakeholders. The stakes are high, and the message is clear — businesses can no longer sideline sustainability. The CSRD sets a new standard for transparency and demands a fundamental transformation in how companies assess, report, and act on their environmental and social impact. While this process requires considerable effort across multiple departments, it also presents an opportunity for profound strategic insight.

This explainer provides companies with an overview of the requirements under the CSRD, including a step-by-step guide on how to navigate the reporting process and drive meaningful change effectively.

CSRD: Redefining the future of sustainability disclosure

The CSRD is a response to the financial sectors’ demand for more transparency to accelerate funding and investments in the sustainable transition. The CSRD installs five key shifts in sustainability reporting:

- Double materiality assessment (DMA) – while materiality assessments aren’t new, the mandatory dual perspective is.

- Life-cycle perspective – through the DMA and the whole report, companies must consider their entire value chain, from cradle to grave.

- Integrating sustainability and commercial priorities – connecting material impacts to business models and strategies is now central.

- Transparency is paramount – companies must be transparent in all processes and steps taken during their assessment and reporting, keeping in mind that the sustainability statement is subject to third-party assurance.

- Expanding data capacity – companies need to enhance their methods of working with data and allocating resources.

The CSRD is part of the EU’s sustainable finance package but closely interlinked with other areas such as due diligence and design

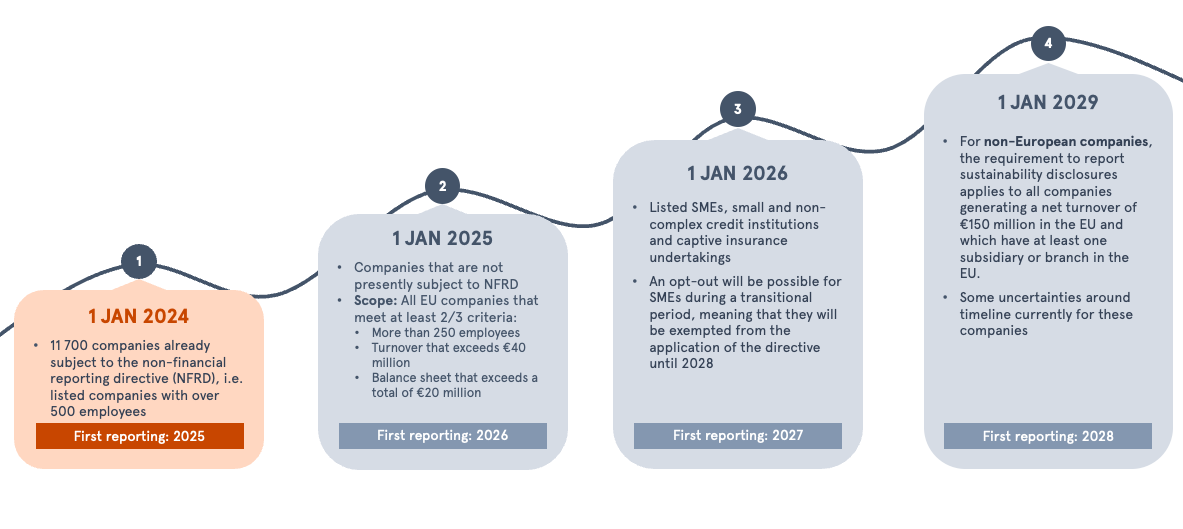

Which companies are in the scope of the CSRD

The sustainability reporting standards (ESRS) of the CSRD

The European Sustainability Reporting Standards (ESRS) are the technical requirements of the CSRD. The ESRS is the most comprehensive framework on sustainability reporting to date and is divided into four areas:

- Cross-cutting (2 standards): Cover overarching topics and processes such as strategy and business model, governance, the materiality assessment, risk management, and internal controls.

- Environment (5 standards): Cover climate change, pollution, water and marine resources, biodiversity, resource use and circular economy

- Social (4 standards): Cover the company’s workforce, workers in the value chain, affected communities, consumers, and end-users.

- Governance (1 standard): Covers business conduct topics such as bribery, corruption, and supplier payment practices.

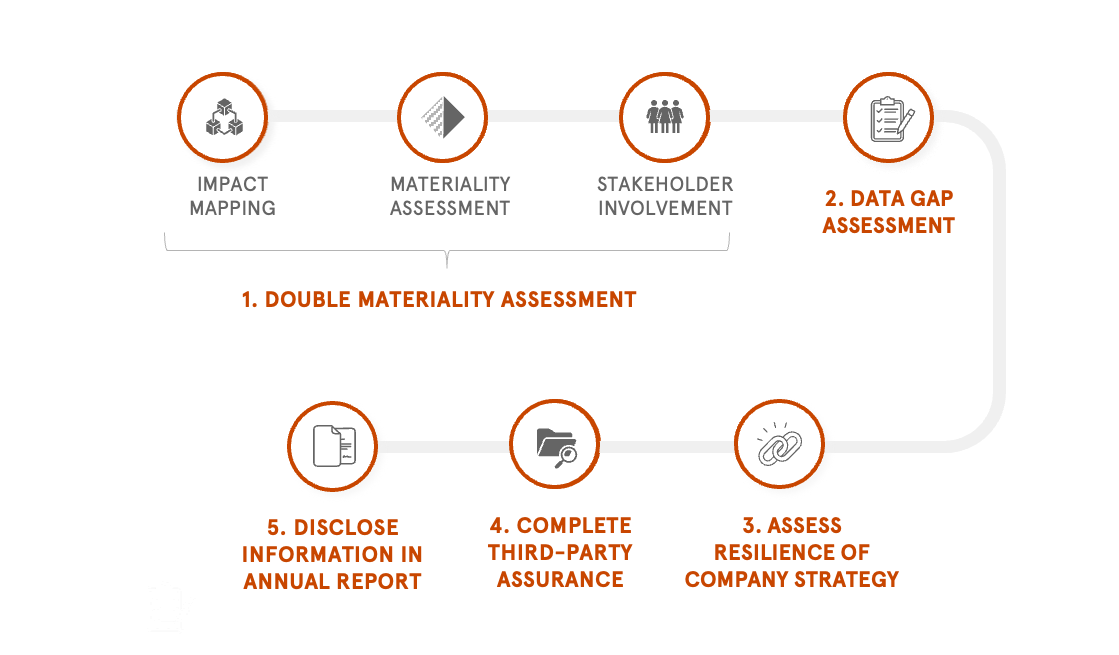

Overview of the CSRD sustainability reporting process

The CSRD establishes a comprehensive scope of data disclosure requirements, compelling companies to rethink their reporting and sustainability strategies. There is no one-size-fits-all approach for all companies. However, here are some measures we implement with our clients to ensure compliance:

- Conduct a double materiality assessment (DMA), including value chain mapping and stakeholder involvement

- Data gap assessment

- Assess resilience of company strategy

- Complete third-party assurance

- Disclose information in an annual report

Companies who want to improve their sustainability performance – to strengthen their attractiveness to investors and customers, for example – should build on the insights from the DMA and the business model assessment and do the following:

- Establish a governance structure

- Review and update relevant policies

- Set short and long-term targets and define monitoring indicators for material issues

- Develop an action plan, short-to-medium term and allocate sufficient resources to ensure sufficient progress towards the set targets

How is the reporting process also a strategy process?

The main goal of the CSRD is to enhance transparency to inform investors. However, this process requires companies to conduct the analysis work that is also commonly part of their sustainability strategy.

It is key to link the company’s business model and commercial plans with its material sustainability issues determined through the double materiality assessment.

Even a simple qualitative assessment is an excellent tool for helping the company grasp whether current commercial plans will exacerbate negative impacts and/or hinder the realisation of key targets, such as climate targets. We use this exercise to discuss and integrate commercial risks and opportunities into the company’s sustainability strategy (thereby driving the integration of sustainability into the commercial priorities).

Hence, the sustainability strategy should not only focus on minimising negative impacts but also serve as a key driver of unlocking new revenue streams, de-risking supply dependencies, and strengthening competitiveness.

The CSRD reporting process step-by-step

Below, we provide an overview of the steps businesses in scope of CSRD must conduct to reach compliance:

Value chain mapping – identifying impacts and stakeholders

CSRD requires a holistic view of the value chain, as many significant impacts, risks and opportunities (IRO) lie outside companies’ own operations. To map the value chain, follow these steps:

- Map the core business activities, processes, and materials that drive the value chain to understand how products and services flow and interact with the various business partners.

- Consider key geographies and markets and make well-informed assumptions where primary data is lacking (for instance, in the early upstream value chain or the late downstream).

- Identify key impact hot spots, focusing on both upstream and downstream segments, where significant environmental, social, or governance impacts are or might occur. These could be in areas such as raw material sourcing, energy-intensive manufacturing processes, or transportation and logistics, but impact areas will differ depending on sector and company-specific circumstances.

- Make a preliminary identification of affected stakeholder groups along the value chain: Now that hotspots have been mapped out, who might be affected by them? Do not forget to consider stakeholders not directly involved in business activities, such as local communities.

Double materiality assessment

The first official step on the CSRD journey is the mandatory double materiality assessment (DMA). The purpose of the assessment is to identify, assess, and prioritise the company’s sustainability IROs across the reporting company’s entire value chain. Those IROs deemed most important (i.e.’ material’ to the company) then define what the company must disclose information about, as they trigger specific Disclosure Requirements and their underlying data points.

For example, Company A identifies topics within the overarching category of ‘climate’ as material and must, therefore, in their annual sustainability statement (ESG report), disclose, i.e.:

- GHG emissions across Scope 1, 2 and 3:

- Climate strategy and governance processes

- Emissions reduction targets and progress towards these targets

- Mechanisms such as internal carbon pricing or sustainability-related remunerations schemes that are in place

A materiality assessment is a commonly used strategy method but note that the EU requires a specific ‘dual’ approach. This means that all identified relevant sustainability matters must be assessed using both the ‘impact’ (‘outside-in) and the ‘financial’ (‘inside-out’) lenses.

For example:

Stakeholder engagement

Engaging with different stakeholder throughout the DMA process is mandatory for identifying sustainability IROs and pressure-testing their assessment. Relevant stakeholders include internal stakeholders, such as employees, and external stakeholders, such as supply chain workers and communities affected by your business activities. Methods such as interviews, surveys and workshops can be utilised to identify the actual or potential impacts experienced by these different stakeholders. There is no set number of actors required to be involved in the process.

Data gap assessment and data gathering roadmap

Once the DMA is complete and the material sustainability topics and their corresponding disclosure required data points have been identified, the reporting company can estimate the workload required for reporting and data collection. By comparing the material data points with the company’s current data availability, it is possible to gauge how much information is still missing to meet the disclosure and data point requirements. Conducting a data gap assessment is not legally required. Still, it is crucial to understand the time and resources needed to close gaps and secure executive buy-in for initiatives such as hiring new staff or covering other reporting-related costs.

We recommend basing the data gap assessment on externally reported information and any internally available data that, while yet to be reported, could be retrieved with minimal effort. This approach provides the most accurate picture of the company’s data maturity. Additionally, we suggest involving the relevant data leads early in the process, ensuring they are fully onboarded and aware of the specific data points for which they are responsible.

Assess the link between business model, commercial strategy, and material issues

Under the CSRD, companies must explain how their business model and commercial strategy are connected or interdependent with their material sustainability IROs.

The undertaking shall disclose its material impacts, risks and opportunities and how they interact with its strategy and business model.

ESRS 2 §46

Simply put, it means that the company must assess whether its business model drives negative impacts and if it will increase its negative impacts over time due to its business model, increased turnover, supply chain, investments, etc. If so, detail what financial effect this might have on the company. Positive impacts and opportunities driven by the business model and their financial implications for the business could also be included in this reporting section.

This assessment can be done qualitatively by building on the DMA and the value chain map and then mapping out the dynamics of the system (on a high level), e.g. by making a causal loop diagram. With time, companies must also report on the financial effects of the interdependencies; however, this is not required for the first year, and companies may, for the first three years, choose to only do so in a qualitative manner. After that, companies must also quantify the financial effects where relevant (CSRD phase-in requirements: ESRS 1 Appendix C).

Scenario example:

Company A makes electronics from virgin materials, which contributes to the depletion of rare earth metals. Company A plans to grow its revenue by 20% over the next 10 years but has made no plans to adjust its product portfolio and business model. Hence, in 10 years, Company A’s negative impact on resource depletion will have increased significantly. So has the financial risk of Company A’s business model and commercial plan, as resource scarcity and accelerating raw material prices become increasingly likely.

Responsible Investor B considers this issue and chooses to favour another electronics company with a more resilient commercial strategy, that seeks to grow revenue while decoupling from risky and unsustainable materials.

Third-party assurance – tips and learnings

All ESRS reports, including the DMA process and its outcomes, are subject to assurance. Since auditors review various reporting formats, it’s crucial to clearly outline the DMA method, process, and assumptions in an easy-to-navigate manner. Including a decision log can help auditors understand the rationale behind IRO scoring.

Companies often overlook that auditors may lack in-depth knowledge of the company, so a clear description of the value chain and its connection to (IROs) aids the auditing process. Subsequently, the same information must also be included in the company’s sustainability statement in the annual report, so being diligent from the start will save you time.

The current challenge is the need for auditors with sufficient sustainability expertise. Nordic Sustainability and other companies engaged in the DMA process experience that some auditors focus more on formalities and technicalities than the core substance of IRO scorings and rationales. Hence, we see cases where the over-implementation of the CSRD is driven more by auditors than the national authorities responsible for transposing the legal text into national law. A way to avoid this issue is to involve the auditors early on so alignment and capacity building happen before the final assurance.

Report structure and digital tagging

Chapter 8 and Appendix F of ESRS 1 (General Requirements) outline the structure of the sustainability statement, which must be a separate section in the company’s management report. Sustainability information should be clearly distinguished from other management report details and structured into four sections: general, environmental, social, and governance information. Repetition should be avoided by cross-referencing relevant details. Sector-specific ESRS disclosures should be grouped by reporting area and topic. Disclosures for environmental objectives under the Taxonomy Regulation must be identifiable. Additionally, companies must digitally tag their reports using XBRL for better data accessibility and comparability, requiring investment in technical expertise.

Requirements of the CSRD have the potential to be a catalyst for real impact and business model change

The CSRD is transformative in its requirements for sustainability reporting and links to business models and strategy. For many companies, the next step will be to develop strategies informed by the double materiality assessment, and this is where the real impact will start. If you have more questions about CSRD, we welcome you to reach out to our in-house expert:

Benjamin Brinch, Regulation & Policy Team Lead

Read more

- CSRD directive and FAQ

How early should your organisation start its CSRD reporting preparations?

Our thoughts on how to start preparing for CSRD reporting process